NinjaTrader TTM Squeeze Indicator is based on three classic technical analysis tools – Bollinger Bands (BB), Keltner Channels and Momentum Oscillator.

A combination of Bollinger Bands (BB), Keltner Channels indicators helps to determine when an asset is consolidating (squeezing) and signals when the price is ready to break out / drop.

The period of low volatility happens when BB stands inside Keltner Channel. The price makes small fluctuations at this moment. However, once BB breaks out Keltner Channel, the volatility increases, indicating that the price is likely to take one of the two possible directions.

At the moment when the price leaves the area with low volatility, attention switches to the Momentum Oscillator. The Momentum Oscillator shows the likely direction of further price movement and helps determine entry / exit points.

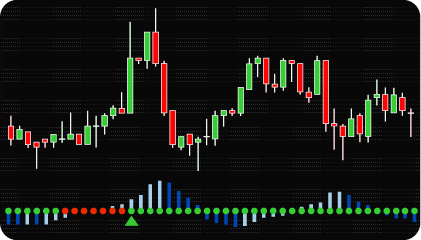

Visually, the NinjaTrader TTM Squeeze indicator consists of a histogram and small dots located along the zero line, indicating whether the asset is in squeeze.

When the volatility is low, the dots are painted in red. Once the volatility grows, and the Bolinger Bands indicators break outside Keltner Channel, the dots change their color to green. This is when it is important to focus on the Momentum histogram. It shows the direction of the price to move. If the histogram is above the basic 0 level, the price is likely to grow, while being below this basic 0 level, Momentum indicates a probability of further price plunge.

The indicator can be used in various breaking and trend following strategies. This tool allows traders to find entry points when the price suddenly breaks the range and goes in one of the directions. In trend following strategies, this indicator helps traders to find out the current market situation and make more reasonable decisions.

NinjaTrader TTM Squeeze Indicator allows you to set up various types of alerts.

By default, the indicator uses standard Bollinger Bands and the original Keltner Channel settings, as well as a 20-period Momentum Histogram, but the number of periods and other settings can be adjusted to your preference.

The most common strategy one can use when dealing with NinjaTrader TTM Squeeze Indicator is a breakthrough tactics when the price makes a strong move in one of the directions after a period of range fluctuations.

Once the dots become green, this is an alert for the trader to prepare to open positions. The best moment to enter into the market is when the histogram breaks the 0 line out or down. If it goes above the basic level, it is time to place a BUY order. If the price breaks the basic level down, a trader can place a SELL order.

The indicator features two signal types:

Standard Mode: In this mode, a buy signal is generated when the histogram is above the zero line, while a sell signal is triggered when the histogram drops below the zero line.

Ascent/Descent Mode: Here, a buy signal is produced when the histogram shows an upward trend, regardless of its position relative to the zero line. Conversely, a sell signal is activated when the histogram exhibits a downward trend.

The indicator is designed for various timeframes allowing users to apply short, mid-, and long-term strategies. If the same signal appears on various consecutive timeframes, this makes it even stronger.

The indicator has the following parameters:

Alerts – setting up various types of alerts.

Signal Mode – selecting signal type: Standard Mode or Ascent/Descent Mode.

Parameters – setting individual indicator parameters (Period, Bollinger Bands standard deviation, Keltner Channel multiplier).

Squeeze length is a special function that allows you to set the minimum number of red dots (enabled squeeze points) for a signal to appear.

We can also turn the indicator into an Automated Trading Strategy with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

| Signal Plot Name |

Signal Plot Values | Description |

| Momentum | Value | |

| SqueezeOn | not nan (0) | |

| SqueezeOff | not nan (0) | |

| Long | not nan (0) | BUY Signal |

| Short | not nan (0) | SELL Signal |

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.