NinjaTrader Support & Resistance Breakout Indicator helps traders identify support and resistance levels and analyze breakouts of these levels. A break through a support or resistance level may indicate a change in price direction or the start of a new trend.

The indicator identifies only those levels that were formed as a result of several attempts to test the price level, which increases their significance and reliability. Thus, the indicator identifies breakouts that have the highest probability of continuing price movement in a certain direction. The indicator is especially effective for timely detection of the moment of breakout of important support / resistance levels, allowing traders to determine the optimal points to enter trading positions.

The indicator provides the ability to configure parameters that allow it to be adapted to the individual needs of the trader. For example, you can adjust the parameters of the minimum number of level tests performed, the minimum number of bars between these tests, and the minimum threshold bet for the breakout area. This makes the indicator an even more flexible and universal market analysis tool. With the help of optimally selected parameters, a trader will be able to increase the accuracy and efficiency of indicator signals, which, in turn, will help make more informed trading decisions and reduce risks.

In order not to miss profitable opportunities for opening trades, the indicator provides settings for various types of alerts.

The strength of a support / resistance level is determined by how many times the price touches it before moving back. Stronger support and resistance levels are those that the price has touched multiple times during a given period. It is these levels that the algorithm of the S&R Breakout Indicator allows you to identify and track their breakdown.

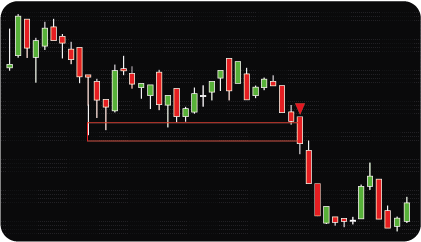

Breakouts of support and resistance levels can provide traders with good trading opportunities as they often signal a change in price direction.

When the price breaks through a support or resistance level, it may indicate that it is ready to begin a new move in a certain direction. In such a situation, traders can use the received signals to open positions in the direction of the breakout, as this may indicate the start of a new trend. By entering the market early in a trend, traders can gain a trading advantage over other market participants.

If the price breaks the resistance level, this is a buy signal. Conversely, if the price breaks through the support level, this is a signal to sell.

The indicator has the following parameters:

Alerts – setting up various types of alerts.

Period – width of the range used to define pivot points.

Max Breakout Length – range of bars to look for breakouts.

Threshold rate % – breakout zone channel width in %.

Minimum Number of Tests – minimum number of tests of the support / resistance level.

Minimum number of bars between tests – minimum number of bars between tests.

We can also turn the indicator into an Automated Trading Strategy with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.