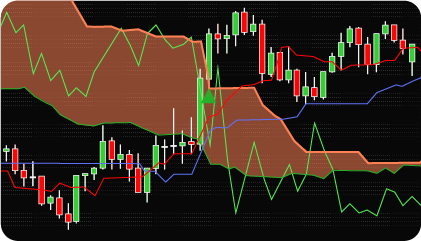

NinjaTrader Ichimoku Indicator is a universal indicator, which is actually a whole autonomous trading system, consisting of several indicators, each of which performs its own special function.

A specially thought-out set of indicators included in the Ichimoku system, allows you to simultaneously provide information about the direction of the trend and the levels of support and resistance, which makes this indicator a multifunctional trader’s assistant for assessing the current market situation and making informed trading decisions.

Ichimoku Indicator developed by us for the NinjaTrader 8 platform includes 5 types of strategies: Ichimoku Cloud (Kumo) Breakout, Tenkan Sen / Kijun Sen Cross, Kijun Sen Cross, Senkou Span Cross, Chikou Span Cross with advanced settings to detect strong, neutral and weak signals.

The NinjaTrader Ichimoku Indicator allows you to set up different types of alerts.

Ichimoku Indicator consists of five main components (indicator lines), each of which has its own name, construction method and function assigned to it:

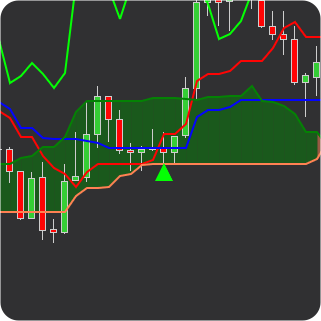

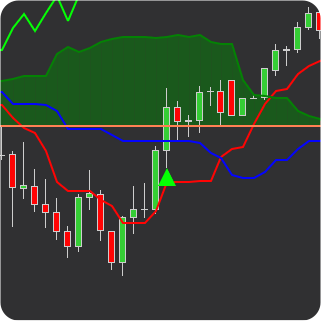

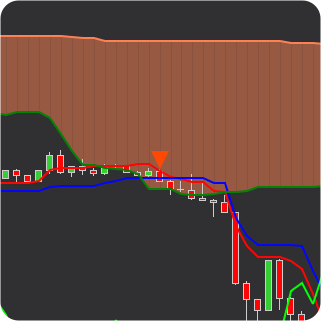

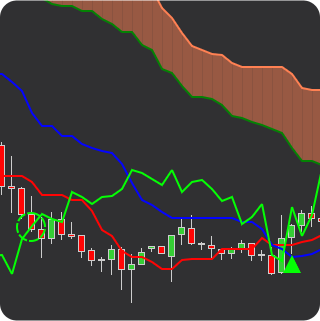

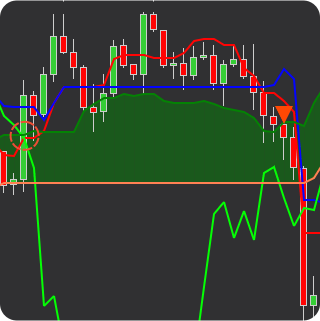

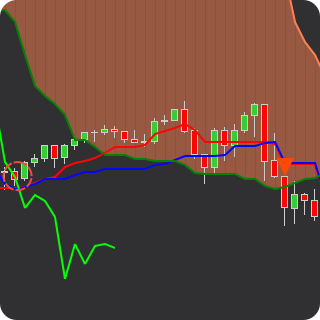

Essentially a cloud (Kumo) formed by Senkou lines Span A and B, is the zone of support and resistance of the trend. And also a trend indicator: if the price is in the cloud, the market is flat, and if the price is outside the cloud, there is a trend in the market (if the cloud is at the top, then the trend is down, and if it is down, then it is up).

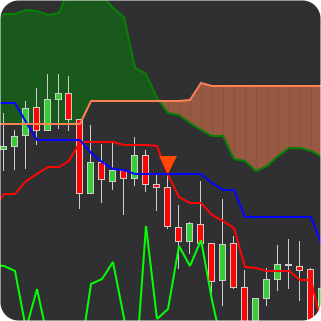

The color of the cloud also indicates the current trend. If the cloud is colored in the color of the first line (dark green), then the market is in an uptrend, and if it is in the color of the second line (coral red), it is a downtrend.

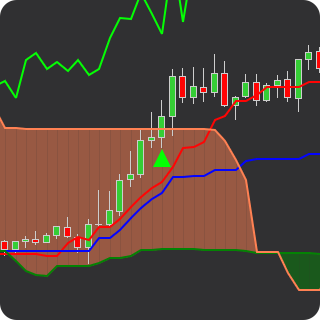

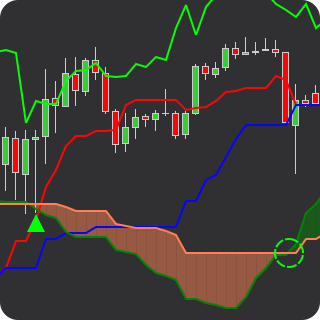

A BUY signal occurs when the price breaks the upper limit of Kumo (Cloud)

When the price breaks the lower boundary of Kumo (Cloud), a SELL signal appears.

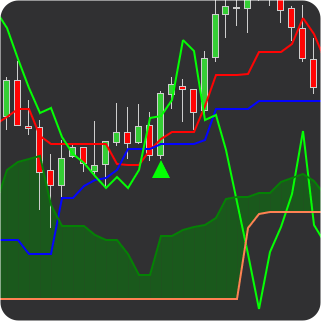

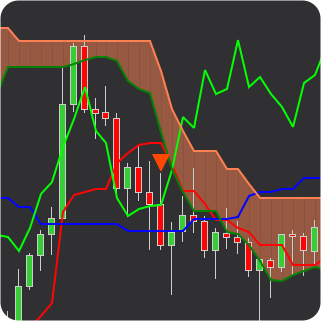

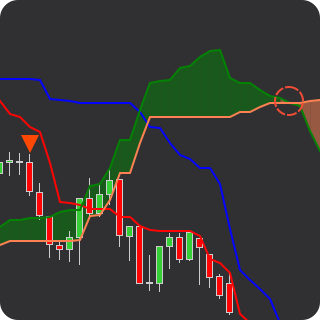

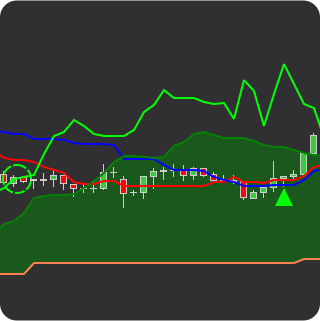

A BUY signal occurs when the Tenkan-Sen crosses the Kijun-Sen from the bottom up.

A weak signal occurs when the crossover is below the Kumo.

A neutral signal occurs when the crossover is inside the Kumo.

A strong signal occurs when the crossover is above the Kumo.

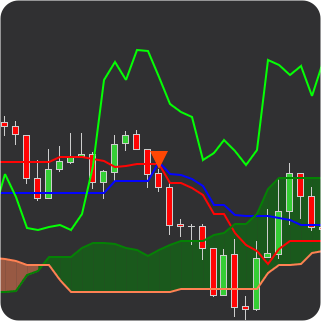

The signal to SELL is the crossing of Tenkan-Sen Kijun-Sen from top to bottom.

A weak signal will be a crossover above Kumo.

The neutral signal will be a crossing inside Kumo.

A strong signal will be a crossing below the Kumo.

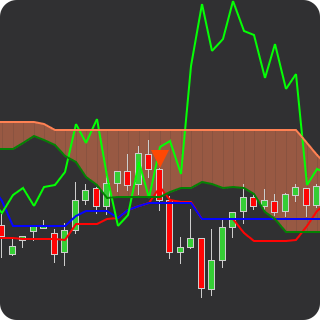

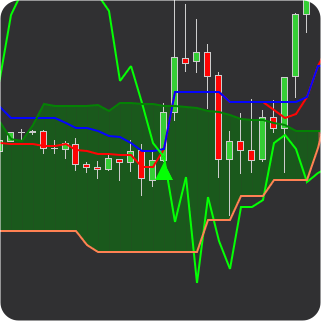

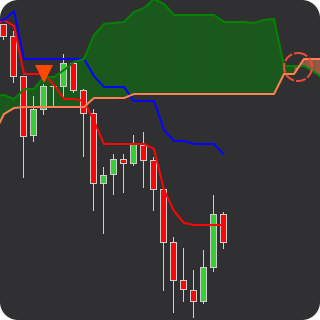

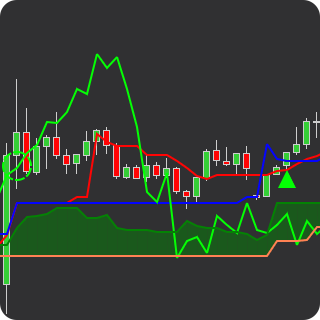

A BUY signal occurs when the price crosses the Kijun-Sen upwards.

The crossover is below Kumo – a weak buy signal.

The crossover is inside Kumo – a neutral buy signal.

The crossover is above Kumo – a strong buy signal.

A SELL signal occurs when the price crosses the Kijun Sen from top to bottom.

The crossover is above Kumo – a weak sell signal.

The crossover is inside Kumo – a neutral sell signal.

The crossover is below Kumo – a strong sell signal.

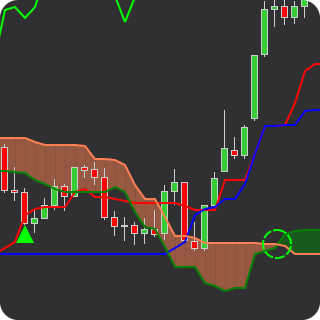

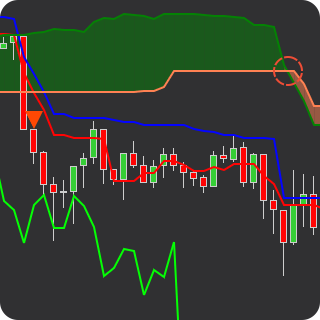

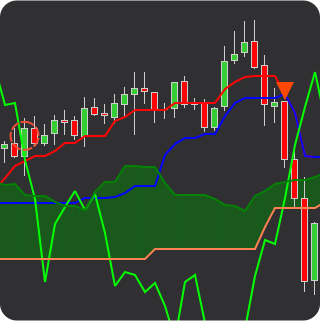

A BUY signal occurs when Senkou Span A crosses Senkou Span B from bottom to top.

A weak signal occurs if the current price is below Kumo.

A neutral signal occurs if the current price is inside Kumo.

A strong signal occurs if the current price is above Kumo.

A SELL signal occurs when Senkou Span A crosses Senkou Span B from top to bottom.

A weak signal occurs if the current price is above Kumo.

A neutral signal occurs if the current price is inside Kumo.

A strong signal occurs if the current price is below Kumo.

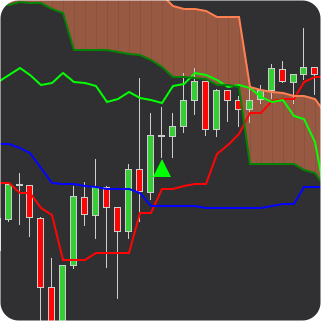

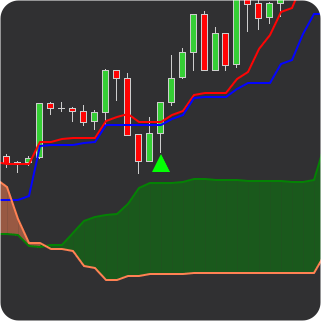

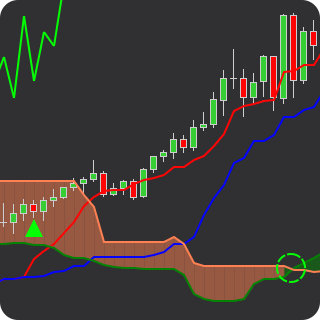

A BUY signal occurs when Chikou Span moves in the direction of the price (up) and crosses it from the bottom up.

Weak signal – the current price is lower Kumo.

Neutral signal – the current price is inside Kumo.

Strong signal – the current price is above Kumo.

A SELL signal occurs when Chikou Span moves in the direction of the price (down) and crosses it from top to bottom.

Weak signal – the current price is above Kumo.

Neutral signal – the current price is inside Kumo.

Strong signal – the current price is below Kumo.

The indicator has the following parameters:

Alerts – setting up various types of alerts.

Parameters – setting individual parameters of Ichimoku lines.

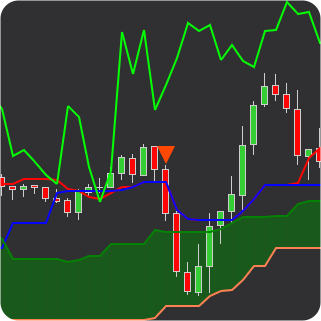

Strategy type – selection of strategy type from 5 available: Ichimoku Cloud (Kumo) Breakout, Tenkan Sen / Kijun Sen Cross, Kijun Sen Cross, Senkou Span Cross and Chikou Span Cross.

Enable Strong signals – enable / disable strong strategy signals.

Enable Neutral signals – enable / disable strategy neutral signals.

Enable Weak signals – enable / disable weak strategy signals.

| Signal Plot Name |

Signal Plot Values | Description |

| WeakBullish | > 0 | BUY (Weak Signal) |

| NeutralBullish | > 0 | BUY (Neutral Signal) |

| StrongBullish | > 0 | BUY (Strong Signal) |

| WeakBearish | > 0 | SELL (Weak Signal) |

| NeutralBearish | > 0 | SELL (Neutral Signal) |

| StrongBearish | > 0 | SELL (Strong Signal) |

| TenkanSen | Indicator value | |

| KijunSen | Indicator value | |

| ChikouSpan | Indicator value | |

| SenkouSpanA | Indicator value | |

| SenkouSpanB | Indicator value |

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.