NinjaTrader Divergence Indicator is designed to determine the well-known trading concept – divergence on the classic RSI, Stochastic and MACD technical analysis indicators.

A divergence is formed on the chart when the price of an asset moves in the opposite direction of the technical indicator. Divergence is used by traders as a signaling feature of a possible trend reversal or its continuation (the price will continue to move in its current direction). The detected divergence is a reliable signal, but is rarer than standard oscillator signals.

The indicator developed by us detects divergence on three technical indicators – RSI, Stochastic and MACD, the parameters of which you can change according to your personal preferences.

In order not to miss trading signals, various types of alerts can be configured.

The indicator defines two types of divergences – regular (classic) and hidden. If you use only one type of divergence for analysis, you can disable the unused one in the settings.

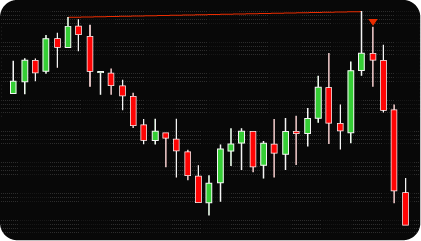

The indicator visualises detected divergences in the form of lines connecting price extremes (maximum and minimal price values), as well as entry triangles (pointers) that display the proposed trading direction.

Green triangles are for buying (long) trades, while red triangles signal potential selling (short) trades. Depending on the type of divergence – bearish or bullish – the lines are colored red or green.

It signals a possible trend reversal.

Regular bullish divergence – price makes lower minimums and the oscillator makes higher minimums.

Regular bearish divergence – price makes a higher mахimum and the oscillator makes a lower maximum.

They are displayed on the chart as solid lines.

It signals a possible continuation of the trend.

Hidden bullish divergence – price makes a higher minimum, but the oscillator makes a lower minimum.

Hidden bearish divergence – price makes a lower maximum and the oscillator makes a higher maximum.

They are displayed on the chart as dashed lines.

The indicator has the following parameters:

Alerts – setting up various types of alerts.

BaseIndicator – indicator selection for detecting divergences.

LookbackPoints – defines the lookback period during which a divergence may occur.

EnableClassicDivergences – enable/disable the detection of regular (classic) divergences.

EnableHiddenDivergences – enable/disable detection of hidden divergences.

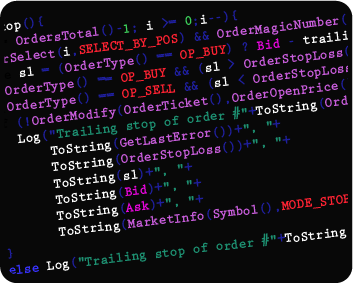

We can also turn the indicator into an Automated Trading Strategy with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

| Signal Plot Name |

Signal Plot Values | Description |

| Bearish | > 0 | SELL Signal |

| BearishHidden | > 0 | SELL Signal |

| Bullish | > 0 | BUY Signal |

| BullishHidden | > 0 | BUY Signal |

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.