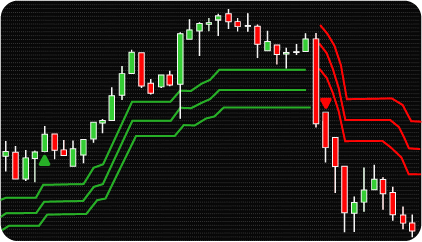

The NinjaTrader Triple SuperTrend Indicator is a comprehensive tool that combines three SuperTrend indicators with additional signal filters, specifically the Exponential Moving Average (EMA) and the Stochastic Relative Strength Index (Stoch RSI). This combination allows traders to make more informed decisions by filtering out weak or false signals and focusing on high-probability trading opportunities. The indicator is a valuable addition to any trader’s toolbox, especially for those who follow trend-based strategies.

The indicator employs a multi-layered approach to trend analysis. Price movements in financial markets are rarely linear; even strong trends experience pullbacks. By using three SuperTrend indicators with different sensitivities, along with EMA and Stoch RSI filters, it effectively captures both the primary trend and short-term fluctuations, enabling traders to make well-informed decisions.

The indicator is particularly effective in trending markets, helping traders identify and capitalize on sustained price movements. It is also useful in volatile markets, as the additional filters distinguish true trends from short-term price fluctuations. Traders can customize the settings to suit their trading style, enabling or disabling filters as needed.

Some of the key features of the indicator include:

The NinjaTrader Triple SuperTrend indicator consists of:

Three SuperTrend indicators – Determine the direction of the trend.

Exponential Moving Average (EMA, 200-period by default) – Confirms the overall trend by smoothing price action to identify long-term trends.

Stoch RSI Oscillator – Measures overbought and oversold conditions, focusing on momentum shifts and potential reversal points.

Buy / Sell Rules

Buy Signal Conditions:

Sell Signal Conditions:

The indicator has the following parameters:

Alerts – Configure various types of alerts.

SuperTrend #1-3 – Set the main parameters of SuperTrends (period and multiplier).

EMA Indicator – Set the period and select the applied price type (OPEN, HIGH, LOW, CLOSE, HL2, HLC3, OHLC4).

Use EMA Filter – Enable/disable the EMA as a signal filter.

SuperTrend Count – Select how many SuperTrends should indicate a bullish (green) or bearish (red) trend (e.g., 3 out of 3 or 2 out of 3).

Stoch RSI Indicator Oversold/Overbought Level – Define the overbought/oversold level values.

Use Stoch RSI Filter – Enable/disable the Stoch RSI as a signal filter.

Stoch RSI Indicator OnZoneEntry / OnZoneExit – Additional signal settings:

We can also turn the indicator into an Automated Trading Strategy with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.