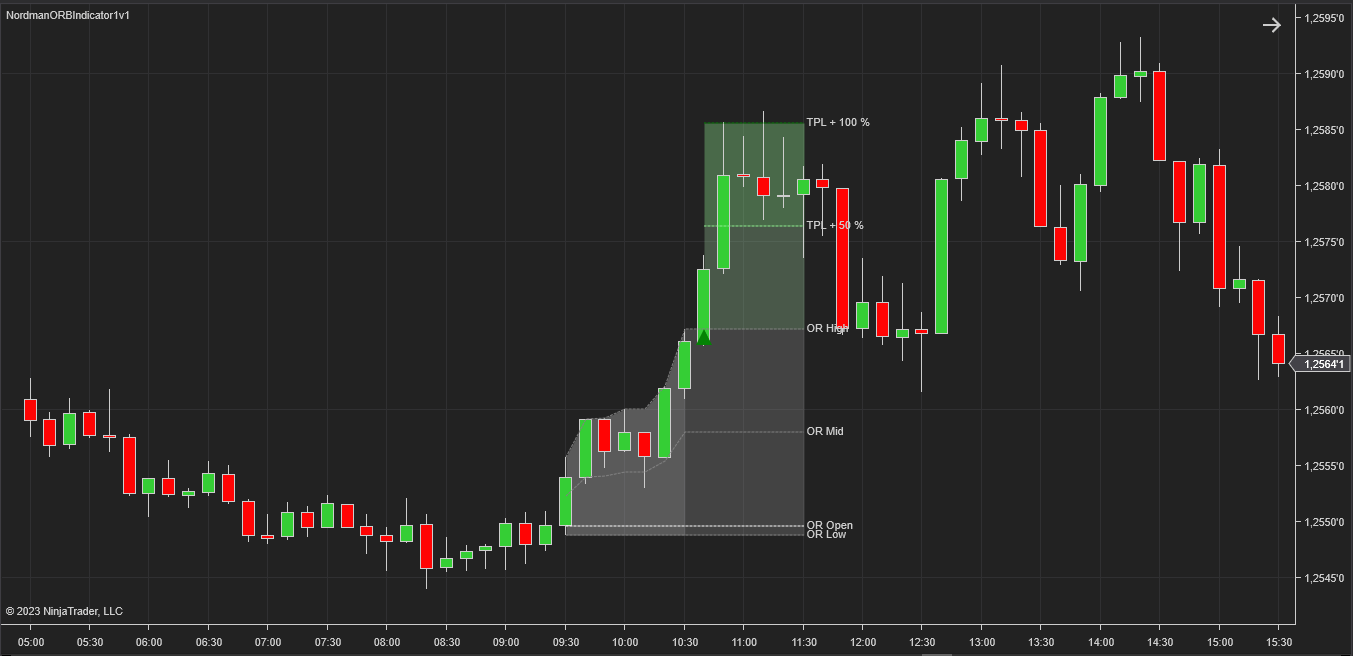

NinjaTrader Opening Range Breakout (ORB) Indicator is designed to track opening range breakouts. Breakouts of the opening range determine the further direction of the price. If the price goes beyond a certain range, then with a high probability it will continue to move in the same direction. Therefore, opening range trading strategies use the range breakout as a signal to enter the market.

The Opening Range Breakout Indicator tracks changes in the width of the trading range. During a trade session, transactions on the market can be carried out with varying degrees of intensity. At some periods of time, trading is conducted less intensively; at these intervals, the range of price changes shrinks. Then, during a period of active trading, the price breaks out of the established range and makes a significant move. This uneven volatility is associated with the daily cyclicality of human activity, determined by the operating hours of exchanges, which can be seen quite clearly on the chart of any trading instrument. Thus, the timing of compression and expansion of the price range is known in advance.

The Indicator begins measuring the price range from the time specified in the indicator settings. Also in the indicator settings you can set the end time of the measurement. In the same way – with two time points – in the settings you set the interval at which the indicator tracks the breakout of the measured price range. Defining a breakout, also depending on the settings, can be done in two ways:

It is assumed that in the interval of active movement, that is, after the breakout, the price will make no less movement than in the interval of low volatility, that is, the measurement interval. Thus, the target level is predicted – the take profit level transactions. If take profit placing trades even closer, this increases the likelihood of its execution, therefore, in addition to the target corresponding to the full range, the indicator draws an additional target at the 50 percent level. The display of target levels is turned on/off in the indicator settings.

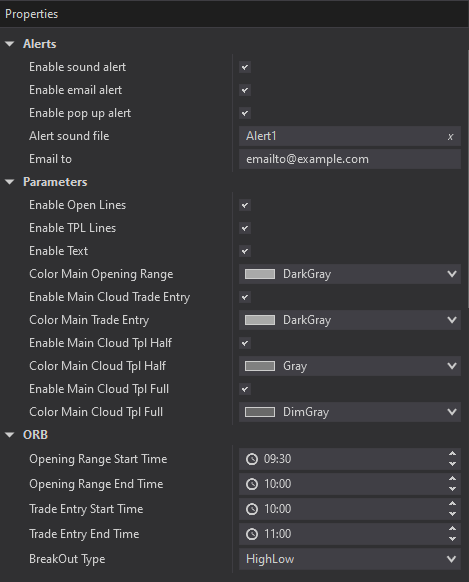

Also in the indicator settings, trader notifications are turned on/off when the breakout range is broken. Notifications can be done by sound (with the ability to select a sound file), email and pop-up message.

To track range breakouts, the indicator can use two independent trading sessions with separate settings for each.

From the very beginning of measuring the price range, the indicator begins to display it on the chart in the form of a cloud – a solid gray area. On the left, the cloud is limited by the start time of the measurement, on the top by the maximum price for this period, on the bottom by the minimum price, and on the right by the current moment in time or the end time of the measurement interval.

The interval at which the breakout of the previously measured range is monitored is also displayed as a gray cloud, but of a different intensity.

The location and direction of a range breakout is indicated on the chart by a signal arrow (an upward breakout is a buy signal, a downward breakout is a sell signal).

Designation of indicator levels:

The indicator has the following parameters:

Alerts – setting up various types of alerts.

Opening Range Start / End Time – setting the start and end times of the opening range.

Trade Entry Start / End Time – setting the start and end time of the time period for entering a trade.

BreakOut Type – setting the type of breakout: by closing price or by High/Low prices.

We can also turn the indicator into an Automated Trading Strategy with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

| Signal Plot Name |

Signal Plot Values | Description |

| Long | > 0 | BUY Signal |

| Short | > 0 | SELL Signal |

| OpenLevel | Value | |

| HighLevel | Value | |

| LowLevel | Value | |

| MidLevel | Value | |

| LongHalfTP | Value | |

| ShortHalfTP | Value | |

| LongTP | Value | |

| ShortTP | Value |

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.