The NinjaTrader TDI Indicator is a multifunctional tool designed to provide traders with comprehensive insights into market dynamics. It integrates three well-known indicators — the RSI (Relative Strength Index), Moving Average, and Bollinger Bands — into a unified system. This combination enables the indicator to simultaneously display trend direction, market strength, and volatility, making it a versatile standalone tool for technical analysis and trading.

The TDI Indicator combines key elements of technical analysis to offer a detailed perspective on market behavior:

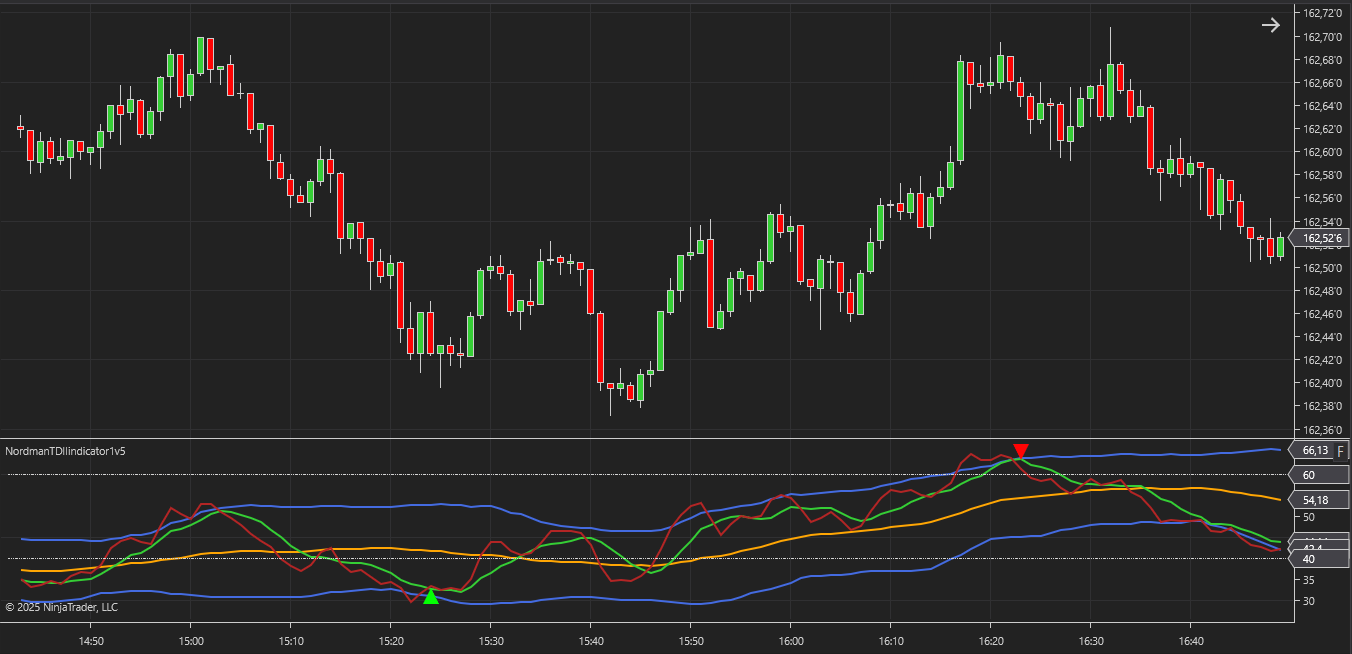

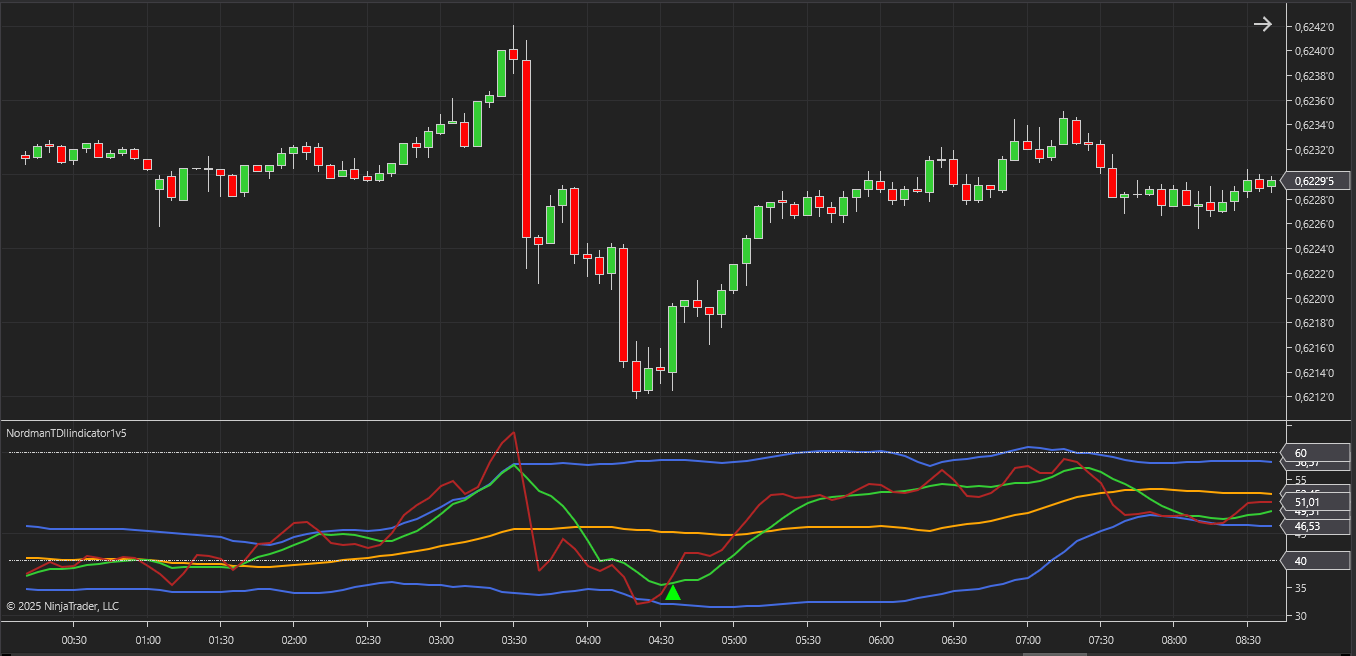

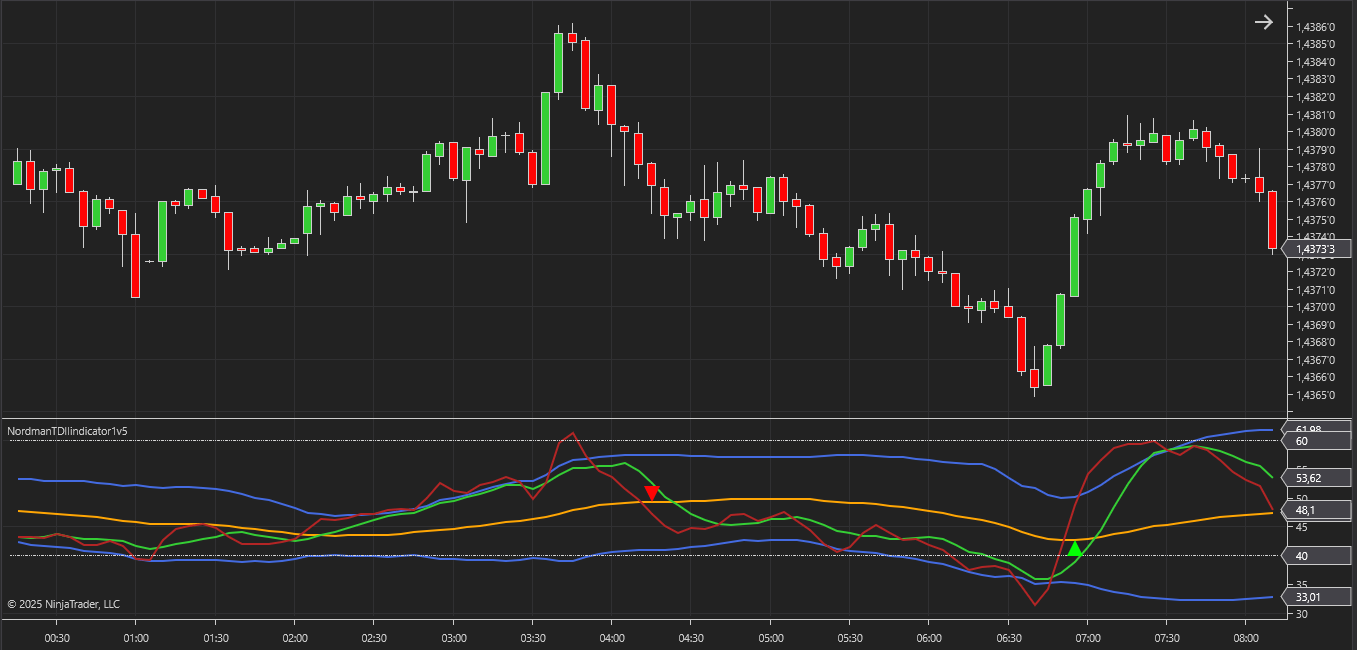

The main lines of the indicator are red (signal line) and green (price line / fast line). Both lines represent the smoothed values of the RSI indicator.

Bollinger Bands are depicted by three lines: the orange line (a Moving Average), which serves as the middle line between the upper and lower borders of the channel, and two blue lines (upper and lower channel borders). These blue lines are also Moving Averages but are shifted by several standard (root mean square) deviations.

Gray (dash-dotted) lines indicate the boundaries of the overbought and oversold zones.

The indicator serves multiple purposes.

Firstly, it can be used to determine the current trend direction. A green line positioned above the orange line signals a shift to an uptrend, while the green line falling below the orange line indicates a transition to a downtrend.

Secondly, the indicator provides early warnings about the start of new trends. For example, when the red line crosses the green line from below, it signals the beginning of an upward trend. Conversely, when the red line crosses from above, it indicates the start of a downward trend.

Additionally, the indicator measures the current strength of the market. A steeper slope of the green line reflects stronger price movement, while a horizontal green line suggests a flat market. Expanding channel lines signal increasing volatility, while narrowing lines suggest decreasing volatility and a reduction in market activity. When the red (signal) line moves beyond the channel boundaries, it often signals a high probability of an impending trend reversal.

PriceAndSignalLinesCross Mode:

In this mode, signals are generated when the signal line (red) crosses the price line (green). A crossover from below to above indicates a BUY signal, while a crossover from above to below generates a SELL signal. This type of signal includes additional settings for signal conditions:

MarketBaseLineCross Mode:

This mode relies on the intersections of the signal line (red) with the middle of the channel (orange). When the signal line crosses the orange line from below to above, it generates a BUY signal. Conversely, a crossover from above to below triggers a SELL signal. Similar to the PriceAndSignalLinesCross mode, the settings provide for the use of additional conditions: the crossing must occur within the overbought or oversold zones, and the red (signal) line must first go beyond the boundaries of the Bollinger Bands.

The parameters for the overbought and oversold zones can be adjusted in the indicator settings. It is important to consider the following when configuring these levels:

Higher Overbought Values: Produce fewer signals but increase their accuracy.

Lower Overbought Values: Generate more frequent signals but may reduce their reliability.

The same principle applies in reverse for the oversold zone. Adjusting these thresholds allows traders to tailor the indicator’s sensitivity to their specific trading strategy and market conditions.

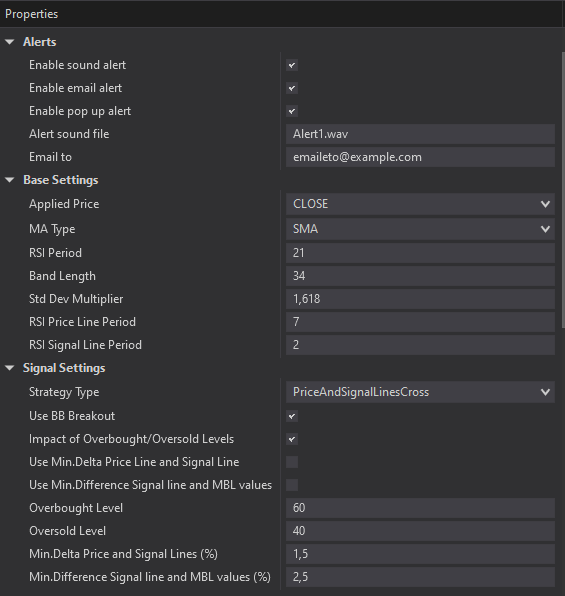

The indicator has the following parameters:

Applied Price – is a choice type prices for calculations (OPEN, HIGH, LOW, CLOSE, HL2, HLC3, OHLC4).

MA Type – selecting the type of moving average calculations.

Std Dev Multiplier – standard deviation multiplier of Bollinger Bands.

RSI Price Line Period – period for calculating the price line / fast RSI line.

RSI Signal Line Period – period for calculating the RSI signal line.

Strategy Type – selection of the indicator signal mode.

Use BB Breakout – enable / disable an additional condition for signal calculation: mandatory presence of a breakout.

Impact of Overbought / Oversold Levels – enable / disable an additional condition for signal calculation: influence of overbought/oversold levels.

Use Min. Delta Price Line and Signal Line – enable / disable the use of the minimum difference between the Price Line and Signal Line values when the lines cross. This parameter is designed to filter out minor crossings of the lines.

Overbought Level – overbought level values.

Oversold Level – oversold level values.

Alerts – setting up various types of alerts.

We can also turn the indicator into an Automated Trading Strategy with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.