Auto Fibonacci Retracement indicator automates the identification of potential support and resistance levels on a chart using the Fibonacci sequence.

The main idea of the Auto Fibonacci Retracement indicator involves identifying areas of price correction based on Fibonacci ratios, which are believed to reflect natural patterns of market behavior.

At its core, Fibonacci retracement theory suggests that after a significant price change (up or down), prices tend to recover a certain portion of that change before continuing the trend or going in the opposite direction. These retracement levels are based on the Fibonacci sequence.

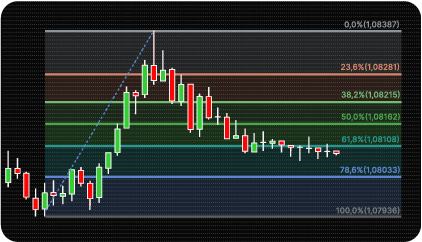

Using the Fibonacci sequence, the Auto Fibonacci Retracement indicator makes it easy to identify potential recovery areas as part of technical analysis. It automates the calculation and visualisation of key Fibonacci retracement levels (23.6%, 38.2%, 50%, 61.8% and 100%) on the price chart. The values for these levels are obtained by taking the two extreme price points, usually the high and low, and dividing the vertical distance between them according to the ratios from the Fibonacci sequence.

Auto Fibonacci Retracement indicator can be a valuable addition to a trader / analyst’s toolkit. By understanding the basic concepts of Fibonacci retracements and integrating the indicator into a comprehensive trading strategy that takes into account other technical indicators and fundamental factors, traders can improve their decision-making process while maintaining effective risk management practices.

Auto Fibonacci Retracement indicator provides the ability to show or hide certain levels, customise their colors for better visualisation, and set alerts that are triggered when prices touch or cross these levels. Additionally, traders can enable or disable custom levels entirely, creating a truly personalised Fibonacci retracement tool.

In technical analysis, traders use Auto Fibonacci Retracement for various purposes:

The indicator has the following parameters:

Alerts – setting up various types of alerts.

Deviation – multiplier that affects how much the should deviate from the previous pivot in order for the bar to become a new pivot.

We can also turn the indicator into an Automated Trading Strategy with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.