NinjaTrader SuperTrend Indicator belongs to the class of trend indicators. It detects trend reversal points with high accuracy, which are ideal for opening trades. Timely accurate signals about the fading of the current trend and the formation of a new trend help to capture trends almost entirely and add trades along the trend.

The indicator has proven itself best on H1 and higher timeframes, since there is less market noise on long time intervals. SuperTrend indicator is optimally suited for medium-term and long-term trading strategies, while scalping on minute timeframes can give incorrect signals.

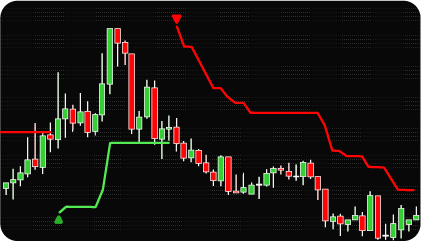

SuperTrend consists of two lines that follow the movements of the chart. The red line moves above the descending chart, the green line is located below the chart when it is directed upwards. Accordingly, the red and green lines represent bearish and bullish trends.

SuperTrend indicator signals are based on ATR data, which measures the degree of volatility. By default, the ATR value is 10, but with an increase in the period, the indicator line smoothes out, showing only significant price movements and a global trend. Reducing the value of this parameter, on the contrary, will make the indicator more sensitive to price changes and, as a result, to an increase in the number of false signals.

The indicator allows you to adjust the parameters of the average true range (ATR) and its multiplier in accordance with your trading strategy.

In order not to miss profitable opportunities for opening trades, the indicator provides settings for various types of alerts.

In the presence of a pronounced trend, when the NinjaTrader SuperTrend indicator is directed up or down, the points of opening and closing deals are determined by the following signals:

The indicator has the following parameters:

Alerts – setting up various types of alerts.

Parameters – changing the key parameters of the indicator (period and multiplier).

We can also turn the indicator into an Automated Trading Strategy with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

| Signal Plot Name |

Signal Plot Values | Description |

| Bullish | Value | |

| Bearish | Value | |

| Long | > 0 | BUY Signal |

| Short | > 0 | SELL Signal |

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.