The NinjaTrader Pivot Point Indicator is a popular tool used by traders to predict market direction and identify potential support and resistance levels.

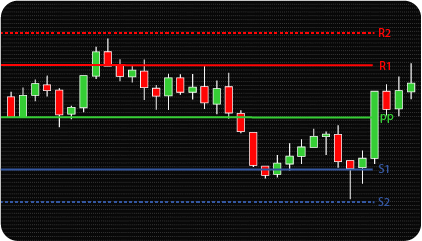

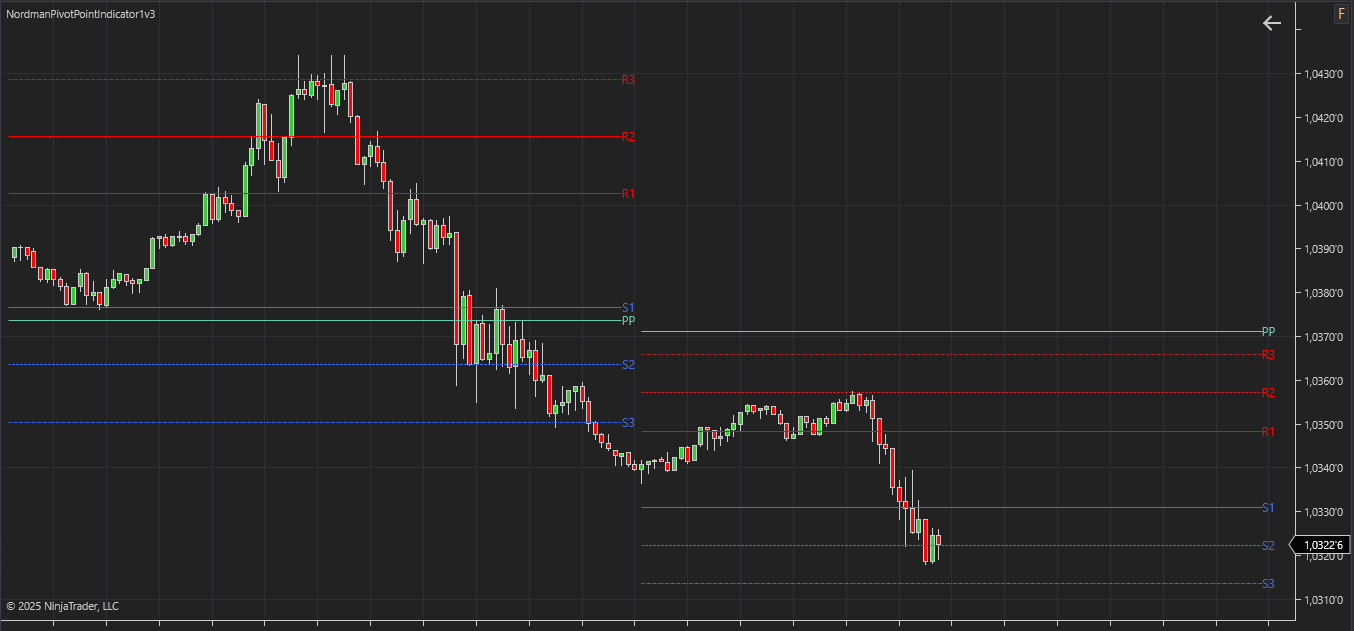

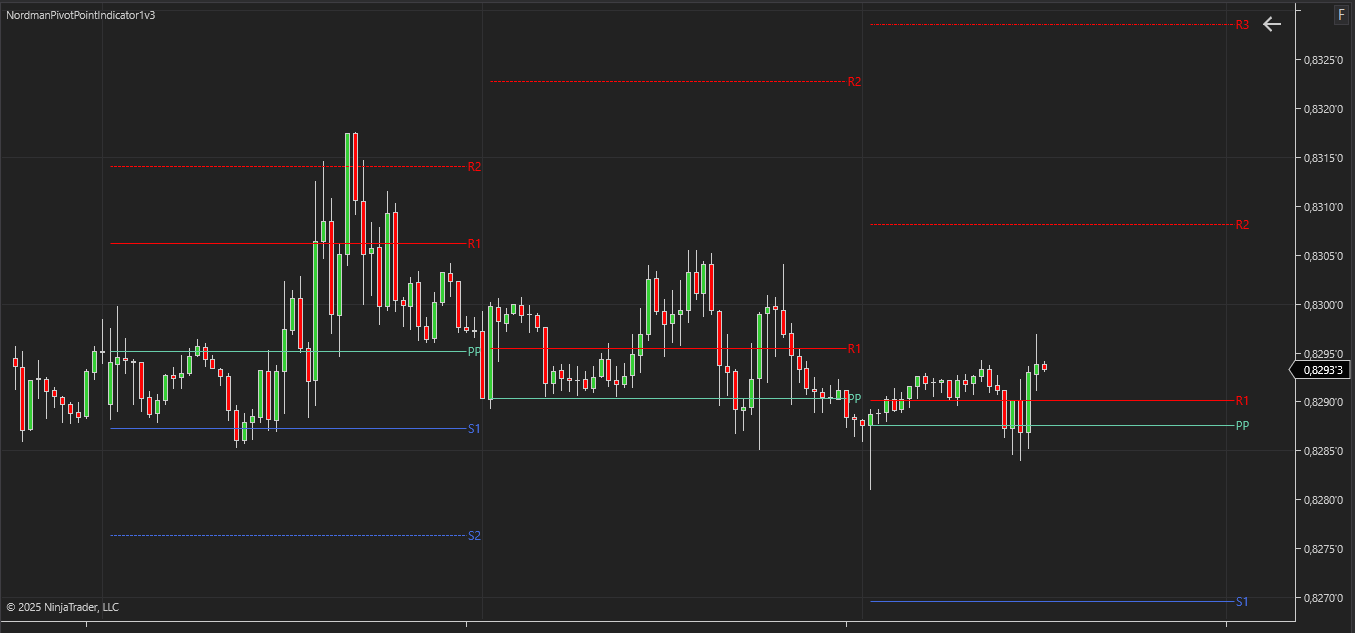

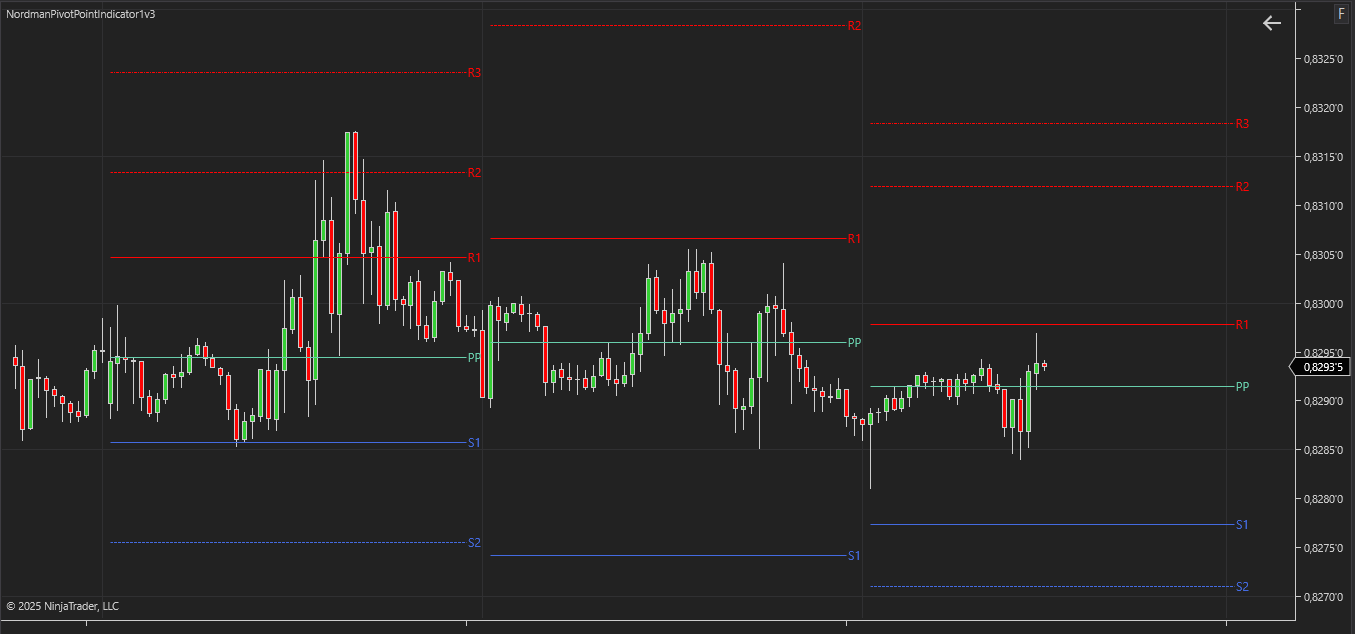

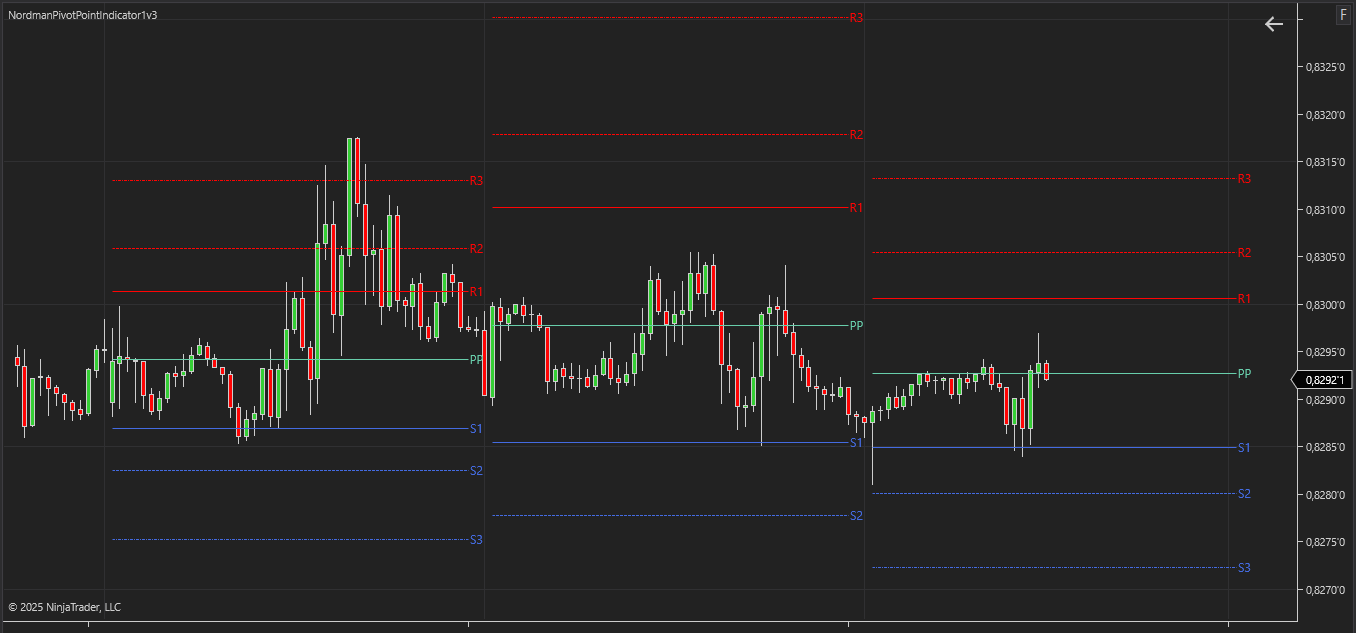

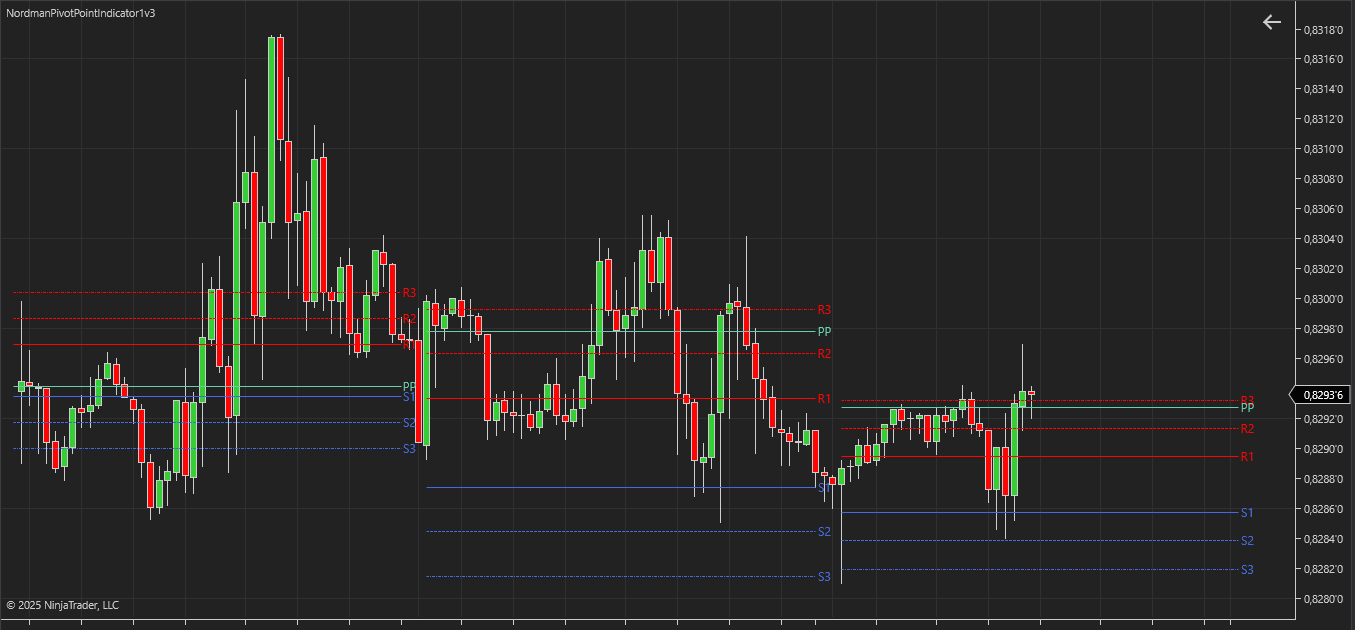

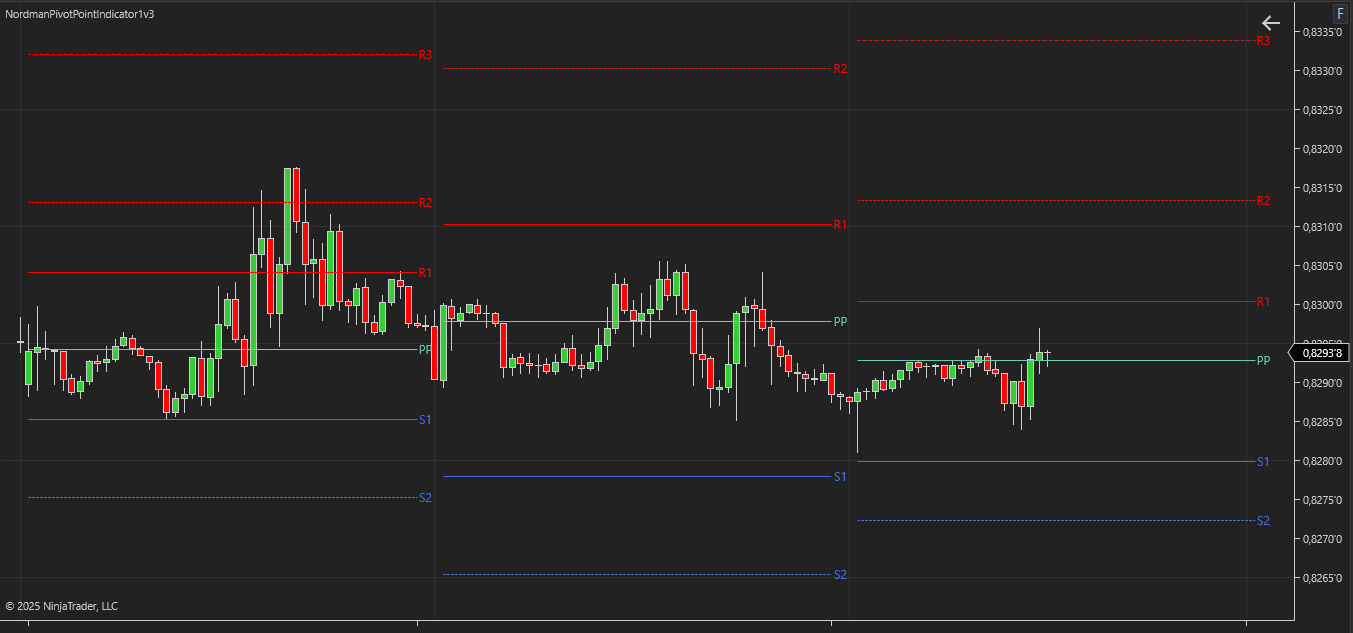

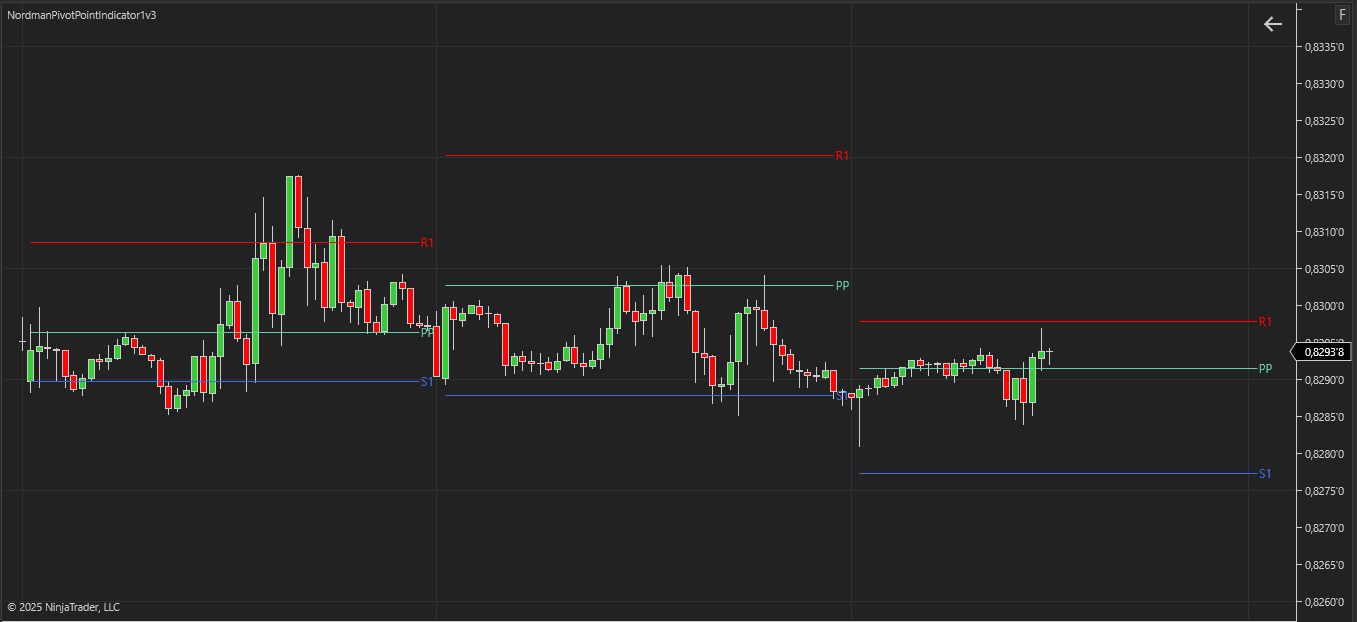

The Pivot Point Indicator is a technical analysis tool that identifies key price levels based on historical price data. The fundamental concept of this indicator revolves around the calculation of a central pivot point (PP), which serves as a reference level. Additional support (S1, S2, S3, … ) and resistance (R1, R2, R3, … ) levels are then calculated around this pivot point. These levels indicate areas where the price may encounter resistance or support, providing valuable insights into market behavior.

The primary purpose of the NinjaTrader Pivot Point Indicator is to assist traders in understanding potential price movements by highlighting critical levels of support and resistance. The main idea is to use historical price action, such as highs, lows, and closing prices, to project future price behavior. This helps traders anticipate where price reversals or continuations might occur, optimizing entry and exit points for their trades.

The NinjaTrader Pivot Point Indicator supports multiple calculation methods, each suited to specific trading styles and preferences:

(1) Standard / Classical: Calculates the pivot point using the high, low, and closing prices of the chosen interval. This method creates four symmetrical support and resistance levels around the pivot.

The formula used to calculate Classical Pivot Points is:

(2) Woodie: Places additional emphasis on the opening price, weighting it more heavily in the calculations. This method provides pivot levels closer to the current market price.

The formula used in the calculation of Woodie Pivot Points are:

(3) Fibonacci: Adds Fibonacci-based support and resistance levels derived from price ranges, offering three levels on each side of the pivot.

The formula used to calculate Fibonacci Pivot Points is:

(4) Camarilla: Uses integer coefficients to calculate support and resistance levels, with symmetrical levels around the closing price.

The formula used to calculate Camarilla Pivot Points is:

(5) Central Pivot Range (CPR): Includes a primary pivot level and an additional level based on the high and low prices of the interval, offering nuanced support and resistance zones.

The formula Central Pivot Range (CPR) calculation:

(6) DeMark: Calculates one primary pivot level and two additional levels, with weights depending on the relationship between the opening and closing prices.

The formula used in calculating DeMark’s Pivot Points:

The indicator allows customization of data intervals, including daily, weekly, monthly, and arbitrary periods, giving traders flexibility in its application. Levels can also be toggled on or off for visual clarity.

The NinjaTrader Pivot Point indicator can be used in various market conditions:

Trend Following: Identifies trends when the price moves significantly away from the pivot point, suggesting a directional bias.

Mean Reversion: Signals potential reversals when the price approaches support or resistance levels.

Breakout and Rebound Strategies: Supports breakout strategies when the price moves beyond resistance or support levels, and rebound strategies when the price bounces off these levels.

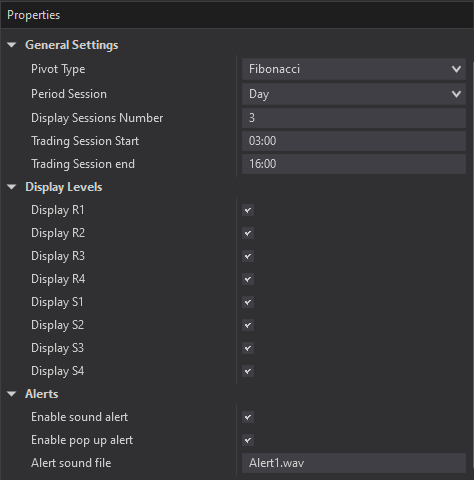

The indicator has the following parameters:

Pivot Type – choice method Pivot Point calculation : Standard / Classical, Woodie, Fibonacci, Camarilla, Central Pivot Range (CPR) and DeMark.

Period Session – selecting a period for data calculation: Day, Week, Month or Custom period.

Display Session Number – number of periods to display.

Display R1- R4 / S1- S4 – individual setting of display of each support and resistance level.

Alerts – setting up various types of alerts.

We can also turn the indicator into an Automated Trading Strategy with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.