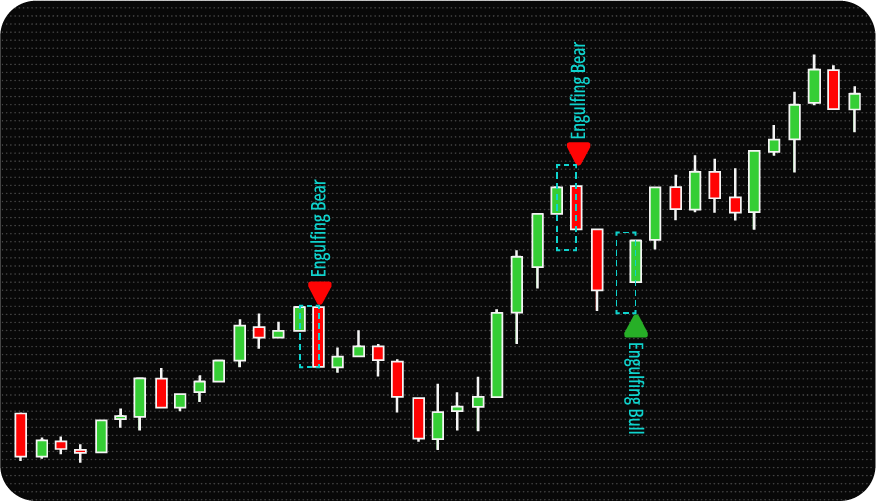

NinjaTrader Candlestick Patterns Indicator helps traders in analyzing charts to detect various candlestick patterns.

A candlestick chart is the most common way to represent the price of an asset. With the passage of time and experience, traders have identified some common candlestick formations (patterns) that signal the continuation and reversal of a trend, support and resistance levels, and an imbalance between supply and demand. There are many candlestick patterns known and used in trading, and we have prepared an indicator that combines the most common patterns in one tool and allows you to visualize them on the chart.

The NinjaTrader Candlestick Patterns Indicator implements a classic approach to the analysis of Japanese candlesticks with maximum preservation of the principles set out in the original sources. Indicator helps to identify the following patterns:

Each of the patterns can be turned on/off independently of other patterns, which allows you to customize the indicator completely according to your preferences. It is also possible to independently change the colors of the elements representing each of the patterns.

The Indicator can display the found patterns on the chart in their original form or filter them in accordance with the current trend. There are three possible options for setting up trend detection:

When determining a trend using one moving average, a bullish trend is considered to be the position of the closing price of the candle above the average, and a bearish trend is considered to be the position of the closing price of the candle below the average. Determining a trend using two moving averages is similar, but the position of the second average is additionally checked. For a bullish trend it should be below the first average, and for a bearish trend it should be above.

Changing moving average parameters is available in the indicator settings.

An upward arrow corresponds to a bullish pattern and is a signal to open a long position. A downward arrow corresponds to a bearish pattern and is a signal to open a short position. To enter the market, it is preferable to use an indicator with trend filtering enabled.

When filtering by one moving average is enabled, this average is displayed on the chart, which provides additional visual control over the market situation. Accordingly, when filtering by two averages is enabled, two additional lines are displayed on the graph.

When a pattern is detected, the indicator can notify the user. In total, the indicator performs notification in three ways: sound, pop-up message and email. Each type of notification is turned on/off independently of other notifications.

The indicator has the following parameters:

Alerts – setting up various types of alerts.

Detect Trend Based On – setting up trend detection.

MA x type / Period / Price Type – setting up moving average parameters to determine the trend (MA type, period, price type for MA calculation).

We can also turn the indicator into an Automated Trading Strategy with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

| Signal Plot Name |

Signal Plot Values | Description |

| Long | > 0 | BUY Signal |

| Short | > 0 | SELL Signal |

| Both | > 0 | BOTH Signal |

| MA1 | Abs. value | |

| MA2 | Abs. value |

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.