NinjaTrader Fractal Breakout Indicator uses fractals to analyze price fluctuations. The main advantage of fractals over other technical analysis tools is that they display not only local highs and lows on the chart, but also allow you to determine important support and resistance levels, which allows you to more accurately analyze price behavior and predict its movement.

A fractal is a cluster of several bars, the outer bars of which are located below and or above the central bar, which represents the top or bottom of the fractal. Thus, there are upper fractals and lower fractals.

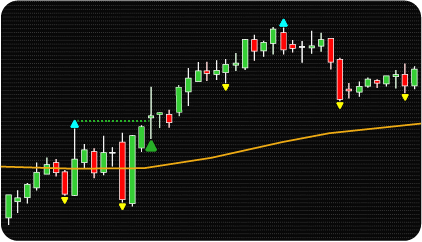

Upper fractals (peaks) are marked by triangles directed upward and located at the level of the maximum price of the bar. Lower fractals (troughs) are marked by triangles pointing down and located at the level of the minimum price of the bar. Fractals indicate the minimums and maximums reached by the market over a certain period, visually highlighting them with directional indicators (triangles).

After detecting the next fractal, the indicator monitors its level. If the price breaks the level of the last upper fractal from the bottom up, this place is marked on the chart as an upward breakout – indicated by a green signal arrow pointing upward and located below the bar on which the breakout was detected. The price crossing the level of the last lower fractal from top to bottom, that is, a downward breakout, is indicated by a red signal arrow pointing down and located above the bar.

For the convenience of the trader, to make it clear which fractal the broken level corresponds to, the indicator draws a horizontal line from the point of the breakout to the top of the corresponding fractal. The levels of upper fractals (pierced from bottom to top) are green, the levels of lower fractals (pierced from top to bottom) are colored red.

If you enable filtering by the moving average in the indicator settings, this average will be displayed on the chart. In this case, the chart will display breakouts only in the direction corresponding to the reading of the moving average – that is, the position of the price relative to the average. Upward breakouts are only shown on the chart if they occur above the average, and downward breakouts are only displayed if they occur below the average.

In order not to miss profitable opportunities for opening trades, the indicator provides settings for various types of alerts.

The most common market theory explains price changes as the interaction of two opposing forces: buyers and sellers. Buyers, providing demand, contribute to higher prices. Sellers, on the contrary, by making offers, help reduce prices. Due to the inertia of market processes, these forces cannot reach equilibrium, as a result of which the price makes oscillatory movements. If the influence of one of the forces significantly exceeds the influence, the second force retreats, and the price makes a strong movement (breakout) with a transition to another price level. Further fluctuations are made within the limits of new price levels, until another breakout occurs and the price makes another significant change.

Fractals clearly show limiting levels, overcoming which leads to a significant change in price. Thus, a price breakout of the upper fractal level is a signal to buy. Conversely, a price breakout of the lower fractal level is a signal to sell.

When a breakout is detected, the indicator can notify the trader in three ways: a text message window, an audio alert, or an email. Moreover, notification can be made both on formed and on emerging bars. When working on formed bars, the trader is notified of a level breakout only after the bar closes, which is a more reliable way to determine a trading signal. Tracking breakouts on emerging bars allows you to identify a breakout as soon as it occurs and make a trade at the best price.

The indicator has the following parameters:

Alerts – setting up various types of alerts.

Fractal – setting fractal parameters.

Moving Average – settings for moving average parameters – used as a signal filter.

Bar signal – signal bar settings: displaying of a signal on a formed bar or on the current one.

Use Trend MA Filter – on / off using a moving average as a signal filter.

We can also turn the indicator into an Automated Trading Strategy with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

| Signal Plot Name |

Signal Plot Values | Description |

| Long | > 0 | BUY Signal |

| LongFractal | Value | |

| Short | > 0 | SELL Signal |

| ShortFractal | Value | |

| MA | Value | |

| UpFractal | Value | |

| DownFractal | Value |

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.