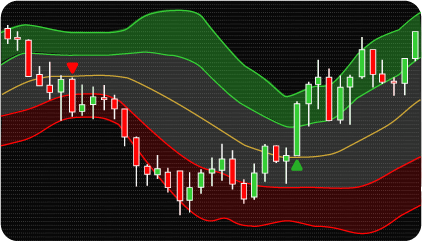

The NinjaTrader Double Bollinger Bands (DBB) Trend-Following Indicator is an advanced technical analysis tool that enhances the traditional Bollinger Bands strategy by utilizing two sets of Bollinger Bands with different standard deviations. This approach enables traders to more effectively identify prevailing market trends. The first set, with a standard deviation of one (1 SD), captures short-term price movements, while the second set, with a standard deviation of two (2 SD), helps identify broader trends.

The core concept of the Double Bollinger Bands strategy is to analyze price interactions with the bands to determine trend strength and direction. By incorporating both 1 SD and 2 SD Bollinger Bands, the indicator provides a more refined method for trend identification, allowing traders to distinguish between a strong uptrend, a strong downtrend, or a neutral phase.

The DBB indicator consists of two sets of Bollinger Bands:

This multi-tiered approach classifies price movements into three distinct zones:

By categorizing price movements into these zones, traders can assess momentum and the likelihood of trend continuation.

The DBB indicator is particularly effective in identifying strong trending environments where prices are consistently moving within specific buy or sell zones. Additionally, it proves valuable during consolidation phases, where price action remains within the neutral zone, indicating a potential trend shift. Traders can leverage the indicator to anticipate breakouts from consolidation periods, enabling them to enter trades with greater confidence and improved timing.

The Double Bollinger Bands (DBB) indicator integrates Bollinger Bands with additional filters to generate more reliable trend-following signals. Bollinger Bands define key trading zones, while EMA, RSI, and MACD serve as confirmation tools to enhance signal accuracy.

Bollinger Bands Structure

Additional Confirmation Filters

By integrating multiple indicators, the DBB strategy balances sensitivity and reliability. The combination of Bollinger Bands, EMA, RSI, and MACD helps traders assess signals from multiple perspectives, improving decision-making while reducing the likelihood of false signals.

Buy / Sell Rules

Buy Signal Conditions:

Sell Signal Conditions:

The indicator has the following parameters:

Alerts – Configure various types of alerts.

Bollinger Bands #1-2 – Set key parameters, including period and standard deviation coefficient.

EMA – Define the period and select the applied price type (OPEN, HIGH, LOW, CLOSE, HL2, HLC3, OHLC4).

RSI – Configure key parameters of the RSI indicator.

MACD – Configure key parameters of the MACD indicator.

Use EMA Filter – Enable/disable the EMA as a signal filter.

Use RSI Filter – Enable/disable the RSI as a signal filter.

Use MACD Filter – Enable/disable the MACD as a signal filter.

MACD Filter Modes: HistogramRelatedZeroLine – The MACD histogram is positive/negative.

MACD Filter Modes: ZeroLineCrossesMACD – The MACD signal line is above the zero line and rising or below the zero line and declining.

Minimum Threshold (%) – Defines the minimum price breakout level above or below the BB1 level.

Percentage Filling Area BB1-BB2 – Specifies the minimum percentage of the buy/sell zone that must be covered by price for a valid signal.

Monitored Price Type – Determines the price type (High/Low or Close) used for calculating the Minimum Threshold (%) and Percentage Filling Area BB1-BB2 parameters.

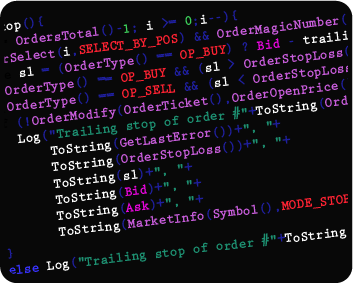

We can also turn the indicator into an Automated Trading Strategy with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.