NinjaTrader Cumulative Volume Delta (CVD) Indicator is a technical analysis tool that measures the difference between buying and selling pressure in the market. Unlike traditional volume indicators that simply display the total volume, CVD takes into account the order flow in detail, showing the net volume of purchases or sales during a specific period.

The main advantage of the CVD indicator is that it works with the flow of actual trades on the exchange, providing advanced market analysis capabilities in real time. The indicator is calculated based on tick data.

By analyzing the market in real time, the indicator provides traders with instant insight into market dynamics, allowing them to quickly adapt to changing conditions. By focusing on the order flow, traders can gain a deeper understanding of market sentiment.

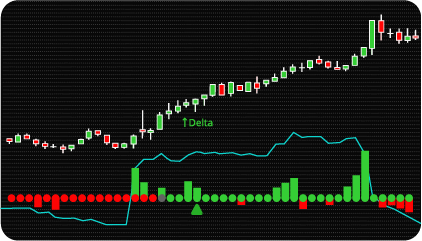

The main purpose of the Cumulative Volume Delta Indicator is to provide traders with insight into market dynamics and imbalances between buyers and sellers. Elevated positive values of cumulative volume delta typically indicate buyer dominance, while negative values may indicate increased pressure from the sellers.

When prices rise along with increased trading volume, it signals a strengthening uptrend, which suggests market support for the current move. Conversely, if prices rise but trading volume decreases, this could indicate potential trend weakness or an upcoming reversal. Thus, cumulative volume delta analysis allows traders to assess the strength or weakness of a trend based on changes in trading volume, which in turn helps them make more informed trading decisions.

Please note!

NinjaTrader CVD Indicator provides various methods for calculating delta:

The indicator’s algorithm goes beyond simple analysis and calculation of cumulative volume delta (CVD) and includes the identification of individual market phases. Determining market phases is necessary as additional confirmation of a change in trend direction. A series of green dots located on the histogram indicates a continuing uptrend, while red dots signal a prevailing downtrend. Gray dots indicate the neutral and uncertain phase of the market. To determine the trend, a combination of SuperTrend and two EMA indicators is used, used either together or separately depending on the preferences of the trader.

It should be noted that this indicator does not generate explicit buy or sell signals. Instead, it effectively identifies the optimal moments for a trend reversal or change in direction. The “⭡Delta” label means that the CVD has reached values and conditions, indicating a likely upward price movement. Conversely, the appearance of the “Delta ⭣” label warns of a likely decline in the asset price.

The indicator allows you to use 2 methods of calculating CVD – by time and by bars.

The indicator allows you to configure filters to determine the minimum volume of trades required to generate trading signals.

The indicator has the following parameters:

Delta Type – selecting the delta calculation method: BidAsk, UpDownTick, or UpDownTick (Forex mod.).

Calculation Type – selection of the CVD calculation method: by time and by bars.

Time / Bars – the value of time or number of bars for calculating CVD. At the specified time / or after the specified number of bars, the calculated CVD values are reset (CVD = 0).

CVD Type – selection of CVD calculation type: Pure, SMA, EMA.

Filter: Volume Total Level – setting the minimum size of the total volume to generate a signal. If set to 0, then the size of the total volume is not taken into account when calculating indicator signals.

Filter: Volume Delta Level – setting the minimum volume delta size for signal generation. If the value is set to 0, then the volume delta size is not taken into account when calculating indicator signals.

Trend Identification – indicators for determining the trend and market phases: a combination of 2 EMA + SuperTrend or using each indicator separately.

EMA Fast / Slow Period – setting the period of fast and slow EMA.

EMA Percentage – minimum difference (in percentage) between the indicators of fast EMA and slow EMA. The parameter is used to determine the trend.

ST Period / Multiplier – settings of key parameters of the SuperTrend indicator.

Alerts – setting up various types of alerts.

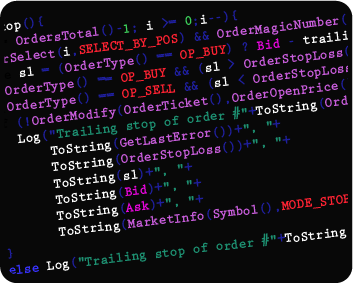

We can also turn the indicator into an Automated Trading Strategy with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.