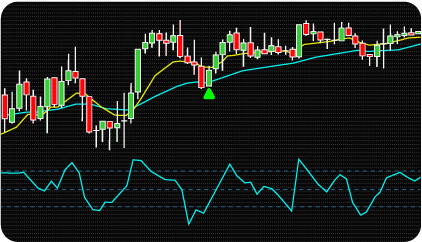

NinjaTrader CCI + MA (EMA / SMA) Indicator, combining two standard technical analysis indicators, allows you to extract maximum efficiency from them. Using two MAs with different averaging periods, the trend (trading direction) is determined.

When a fast MA (having a shorter averaging period) crosses a slow MA (having a longer averaging period) from bottom to top, this indicates the presence of an uptrend in the market. Accordingly, when a fast MA crosses a slow one from top to bottom, this means the beginning of a downward trend.

It is known that the moment immediately after the crossover of two MAs is not favorable for opening a position, since the price is at the peak of its movement. As a rule, after crossing, the momentum weakens and the price moves in the opposite direction for some time. If, after such a reverse movement, the price resumes its movement in the direction of the initial impulse, then a favorable moment arises for opening a position. If the price continues the reverse movement, a reverse crossover of the averages will occur, thus, the false crossover of two MAs will be filtered out.

Immediately after the crossover of two MAs, tracking of the CCI oscillator is activated. In an uptrend, the CCI line should fall below the -100 level. Then, as soon as the CCI crosses this level from below, a buy trading signal will occur. In a downtrend, the CCI line should first rise above the 100 level and then fall below.

A feature of the CCI oscillator is its high sensitivity, therefore, even with a slight reverse price movement, there is a very high probability that during an upward trend the oscillator will drop to the -100 level, and during a downward trend it will rise to the 100 level. Thus, a favorable moment for opening positions will not be missed.

Additionally, to increase reliability, the indicator has the function of filtering minor changes in the MA. The crossover of two MAs is considered to have taken place only if their lines not only crossed, but then diverged by a certain amount, determined in the indicator settings.

To avoid missing profitable opportunities for opening trades, the indicator offers settings for various types of alerts. When a signal appears on the chart, the indicator can notify the trader in any of three ways, which can be turned on / off independently of each other: sound (with the ability to select a sound file), by email, and a pop-up message.

The operating principle of the CCI + MA trading strategy is based on combining the properties of two indicators: following the trend and determining the overbought / oversold state of the market. The CCI helps identify potential trend reversal points, while the MA provides a clear picture of the current trend direction.

A BUY order is initiated when the fast MA crosses above the slow MA and then, after some time, the CCI exits the oversold zone. Conversely, a SELL order is opened when the fast MA crosses below the slow MA and the CCI then exits the overbought area.

The indicator has the following parameters:

Alerts – setting up various types of alerts.

Maximum CCI Expectation – period of waiting for the CCI to exit the overbought / oversold zone after crossing the fast and slow MA (in bars).

Minimum MA’s Delta (%) – parameter that determines the minimum difference in values between the fast and slow moving averages at which the crossover will be considered valid. This setting allows you to filter out frequent MA crossings that may occur during periods of minor market movement.

CCI Oversold / Overbought Level – setting the values of overbought / oversold CCI levels.

Enable Repeat signal – activation of a repeat signal. The signal is repeated if the crossing of the fast and slow MA is still in effect, and in the meantime the CCI executes a re-exit from the overbought / oversold zone.

We can also turn the indicator into an Automated Trading Strategy with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.