MT4 Support & Resistance Breakout Indicator analyses the history of a financial instrument to a fairly significant depth (from 30 to 300 bars, configurable in the indicator’s properties window). On this range of bars, the indicator first reveals local lows and highs of the price. The parameters for detecting these lows and highs are also configured in the indicator’s properties window.

If several local lows or highs are approximately at the same level, within the acceptable deviation (the deviation value is also adjustable), this means that a significant support or resistance level has formed.

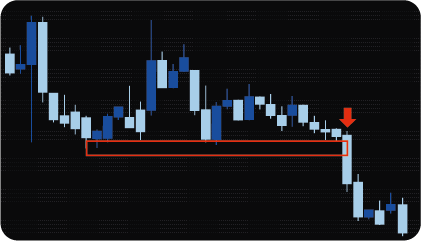

If the price overcomes the zone within which local lows or highs are located, this means a breakout of the level, in this place the indicator will display a signal to open a position. The green arrow pointing up marks the breakout of the upper boundary of the resistance zone and means a buy signal. Accordingly, a red arrow pointing down marks a breakout of the lower boundary of the support zone and signifies a sell signal.

To the left of the arrow, the indicator draws a narrow rectangle covering the lows or highs involved in the formation of a support or resistance zone. The height of the rectangle corresponds to the tolerance or threshold setting.

To track several trading instruments, they must be specified in the indicator properties window (they are entered into one string variable separated by commas). In addition, in the indicator properties window, it is possible to select the timeframes that need to be tracked. Tracking of each timeframe is enabled separately. All specified symbols and selected timeframes will be displayed in a table on the graphical panel of the indicator.

In order not to miss profitable opportunities for opening trades, the indicator provides settings for various types of alerts.

As a rule, the price does not make unexpected breakouts of significant support and resistance levels. Before making a breakout, the price tests the level several times – approaches it, bounces, reverses, reverses and tests the level again. Only after gaining some strength, the price manages to overcome the level, which by that time is already quite clearly identified on the chart.

S&R Breakout Indicator just allows you to identify such levels and track their breakthrough. A break of a significant support or resistance level usually marks the start of a strong trend move and is thus an effective trading signal.

The unique feature of the MT4 S&R Breakout Indicator is that it performs a complete analysis of local lows and highs. That is, the breakthrough of one zone of support or resistance does not mean the cancellation of tracking the other zone, which began to form at an earlier time. Therefore, a confirming trading signal is formed, which contributes to a longer holding of an open position and taking the maximum possible profit of one position.

The dashboard shows information about the current status of detecting signals.

The dashboard is a table with tracked symbols in rows and timeframes in columns.

The cell of the asset/timeframe contains information about the direction of the deal (BUY or SELL) and the serial number of the bar (the number of bars back) on which the signal was detected.

The color of the cell indicates the direction of the deal (BUY – green, SELL – red) and changes the saturation of the main color depending on how much the distance of the bars from the last bar on which the signal was detected increases.

To see the signal on the chart, just click on the cell and the chart will switch to the corresponding symbol and timeframe.

The indicator has the following parameters:

assets – selection of assets to search for signals.

enable_M1 – enable_MN – include / exclude timeframes (from a minute to a month) to search for signals via them.

max_bars – the maximum number of bars back, by which the scanner will search for signals. The parameter limits the number of calculations to speed up the indicator.

enable_alert – the option enables / disables alerts.

enable_email – allows you to send email alerts.

enable_mobile – allows you to send alerts to your mobile device.

Period – width of the range used to define Pivot Points.

Max breakout length – range of bars to look for breakouts.

Threshold rate % – breakout zone channel width in %.

Minimum number of tests – minimum number of tests of the support/resistance level.

Minimum number of bars between tests – minimum number of bars between tests.

We can also turn the indicator into an Expert Advisor (trading robot) with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.