MT4 Ichimoku Indicator monitors the movement of prices in the market and helps to determine the beginning of a new trend and its direction in a timely manner. Due to this, the trader can use the full potential of the trend – opening and closing trades at the most favorable moments.

The main advantage of this indicator is that a trader can choose a strategy that suits his trading style. MT4 Ichimoku Indicator includes 5 types of strategies: Ichimoku Cloud (Kumo) Breakout, Tenkan Sen / Kijun Sen Cross, Kijun Sen Cross, Senkou Span Cross, Chikou Span Cross with advanced settings for detecting strong, neutral and weak signals.

With the the scanning function, the MT4 Ichimoku Indicator can work on several symbols and timeframes at the same time. Detected signals are displayed in the dashboard. The dashboard significantly increases the efficiency of the trader’s work – it allows the trader to assess the market situation as a whole, provides an opportunity to quickly proceed to the analysis of the detected signal and make a decision to open a trade.

The indicator provides for setting up various types of notifications about found signals (pop up alert, email and mobile alerts), as well as separate alert settings for weak, neutral and strong strategy signals.

Ichimoku Indicator is a multifunctional indicator that actually represents a whole autonomous trade a system consisting out of five major components (indicative lines), each from which It has his name, construction method and its special entrusted on the her function:

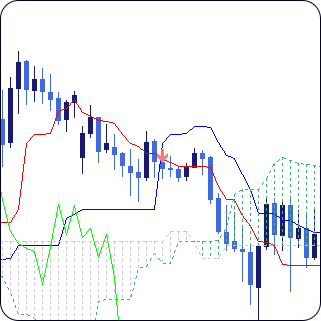

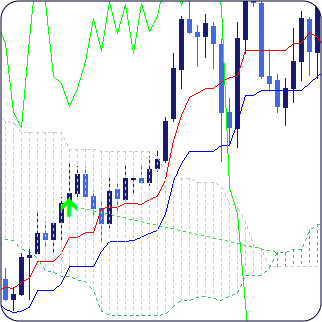

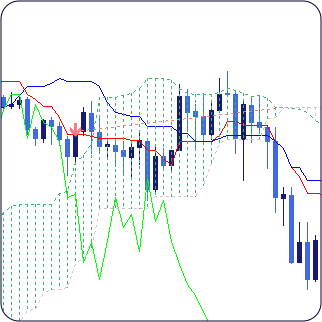

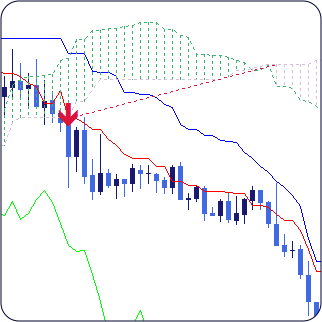

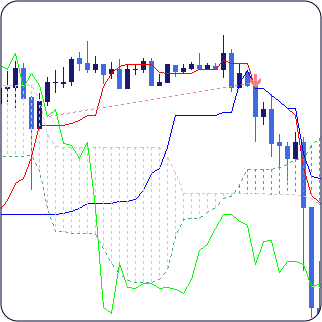

Essentially a cloud (Kumo) formed by Senkou lines Span A and B, is the zone of support and resistance of the trend. And also a trend indicator: if the price is in the cloud, the market is flat, and if the price is outside the cloud, there is a trend in the market (if the cloud is at the top, then the trend is down, and if it is down, then it is up).

The color of the cloud also indicates the current trend. If the cloud is colored in the color of the first line (dotted line), then the market is in an uptrend, and if it is in the color of the second line (dotted line), it is a downtrend.

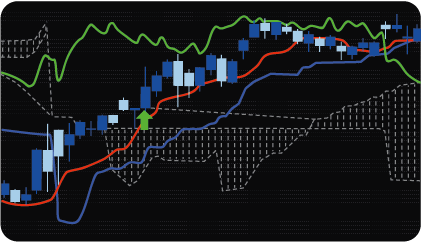

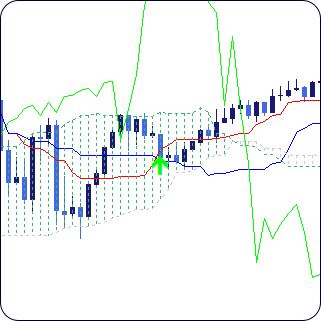

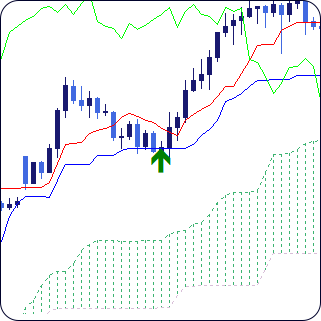

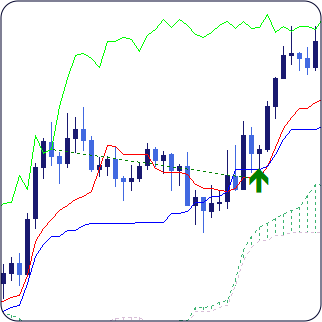

A BUY signal occurs when the price breaks the upper limit of Cloud (Kumo).

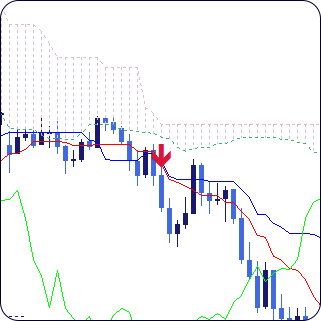

When the price breaks the lower boundary of Cloud (Kumo), a SELL signal appears.

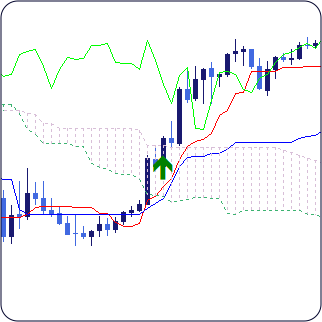

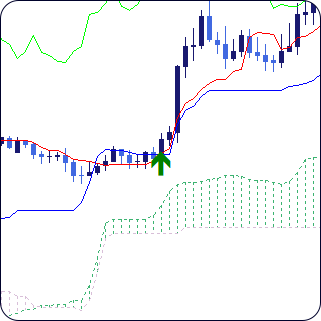

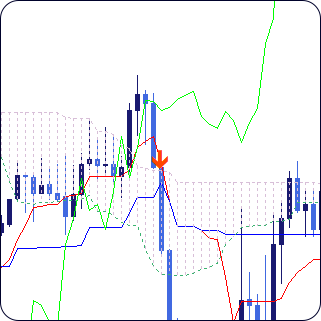

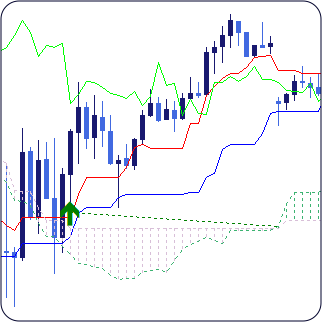

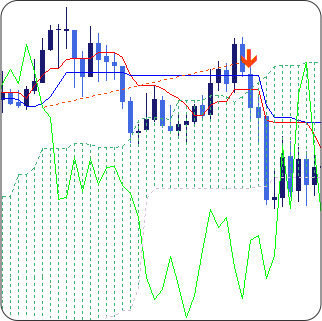

A BUY signal occurs when the Tenkan-Sen crosses the Kijun-Sen from the bottom up.

A weak signal occurs when the crossover is below the Cloud.

A neutral signal occurs when the crossover is inside the Cloud.

A strong signal occurs when the crossover is above the Cloud.

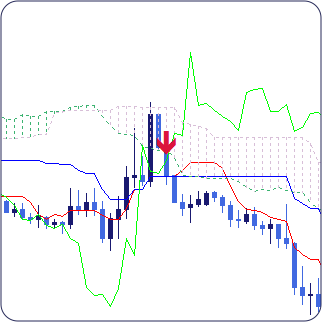

The signal to SELL is the crossing of Tenkan-Sen Kijun-Sen from top to bottom.

A weak signal will be a crossover above Cloud.

The neutral signal will be the crossover inside Cloud.

A strong signal will be a crossover below the Cloud.

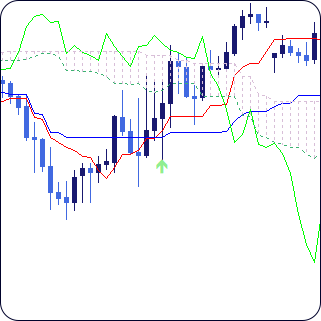

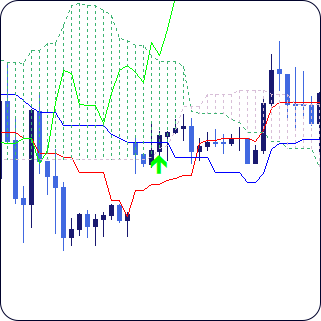

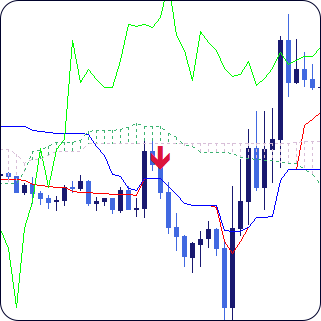

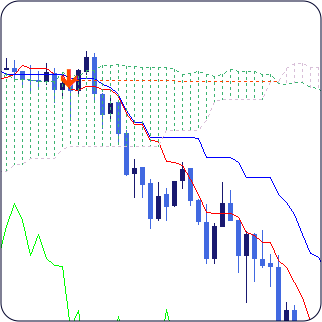

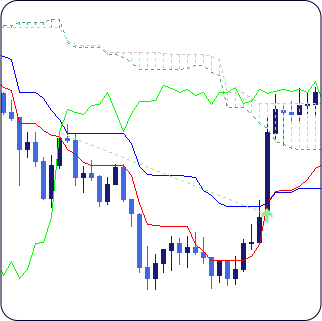

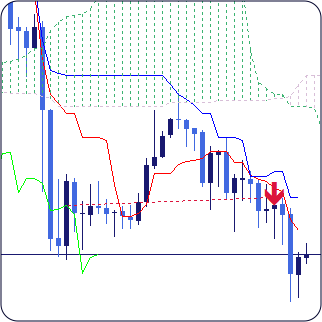

A BUY signal occurs when the price crosses the Kijun-Sen upwards.

The crossover is below Cloud – a weak buy signal.

The crossover is inside Cloud – a neutral buy signal.

The crossover is above Cloud – a strong buy signal.

A SELL signal occurs when the price crosses the Kijun Sen from top to bottom.

The crossover is above Cloud – a weak sell signal.

The crossover is inside Cloud – a neutral sell signal.

The crossover is below Cloud – a strong sell signal.

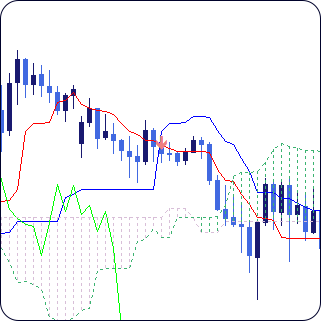

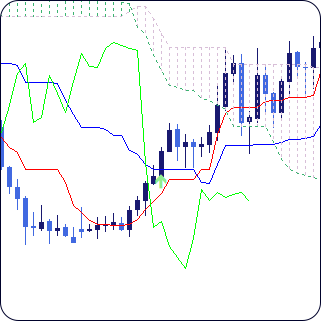

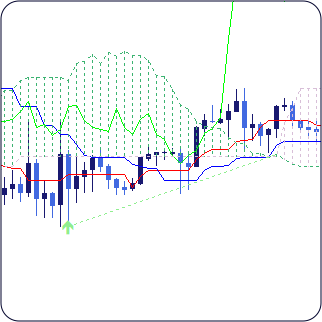

A BUY signal occurs when Senkou Span A crosses Senkou Span B from bottom to top.

A weak signal occurs if the current price is below Cloud.

A neutral signal occurs if the current price is inside Cloud.

A strong signal occurs if the current price is above Cloud.

A SELL signal occurs when Senkou Span A crosses Senkou Span B from top to bottom.

A weak signal occurs if the current price is above Cloud.

A neutral signal occurs if the current price is inside Cloud.

A strong signal occurs if the current price is below Cloud.

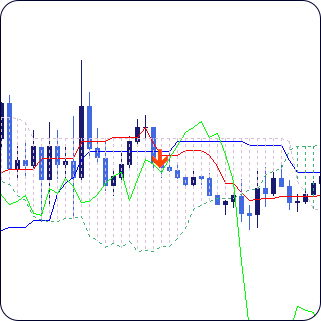

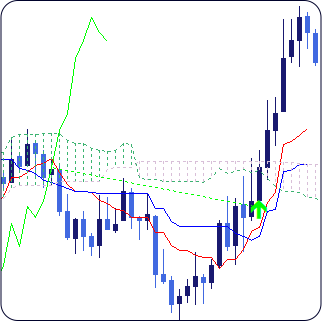

A BUY signal occurs when Chikou Span moves in the direction of the price (up) and crosses it from the bottom up.

Weak signal – the current price is lower Cloud.

Neutral signal – the current price is inside Cloud.

Strong signal – the current price is above Cloud.

A SELL signal occurs when Chikou Span moves in the direction of the price (down) and crosses it from top to bottom.

Weak signal – the current price is above Cloud.

Neutral signal – the current price is inside Cloud.

Strong signal – the current price is below Cloud.

The dashboard shows information about the current status of detecting signals.

The cell of the asset / timeframe contains information about the direction of the trade (BUY or SELL), signal strength (weak, neutral, strong) and the serial number of the bar (the number of bars back) on which the signal was detected.

The color of the cell indicates the direction of the trade (BUY – green, SELL – red) and changes the saturation of the main color depending on how much the distance of the bars from the last bar on which the signal was detected increases.

The dashboard allows traders to easily and fastly choose the assets they want to work with by clicking on a particular cell in the dashboard.

The indicator has the following parameters:

assets – selection of assets to search for signals.

enable_M1 – enable_MN – include / exclude timeframes (from a minute to a month) to search for signals via them.

max_bars – the maximum number of bars back, by which the scanner will search for signals. The parameter limits the number of calculations to speed up the indicator.

enable_alert – the option enables / disables alerts.

enable_email – allows you to send email alerts.

enable_mobile – allows you to send alerts to your mobile device.

Ichimoku Settings – setting individual parameters of Ichimoku lines.

indicator_type – selection of strategy type from 5 available: Ichimoku Cloud (Kumo) Breakout, Tenkan Sen / Kijun Sen Cross, Kijun Sen Cross, Senkou Span Cross and Chikou Span Cross.

enable_strong_signals – enable / disable strong strategy signals.

enable_neutral_signals – enable / disable strategy neutral signals.

enable_weak_signals – enable / disable weak strategy signals.

enable_strong_alerts – enable / disable alerts about detected strong strategy signals.

enable_neutral_alerts – enable / disable alerts about detected neutral strategy signals.

enable_weak_alerts – enable / disable alerts about detected weak strategy signals.

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.