MT4 Pivot Point Indicator is used by traders to predict market direction and identify potential support and resistance levels.

The Pivot Point is the fundamental element of this Indicator and is used to identify key support and resistance levels that are predicted based on the Pivot Point calculation. These levels help traders determine where price may encounter support or resistance.

In an uptrend market, the Pivot Point and resistance levels may indicate an upper price level, above which the uptrend is no longer sustainable, potentially leading to a reversal. In a falling market, the Pivot Point and support levels may indicate a low price level, below which the decline may slow or stop.

MT4 Pivot Point Indicator provides calculation of levels in one of the following ways:

(1) Standard / Classical. When using this algorithm, the Pivot Point is calculated based on the maximum, minimum and closing price of the calculation interval. Additionally, based on the minimum / maximum value from the reference point, the Indicator calculates support / resistance levels. A total of four support levels and four resistance levels are calculated. These levels are located symmetrically relative to the Pivot Point.

The formula used to calculate Classical Pivot Points is:

(2) Woodie. In this calculation, instead of the closing price, the opening price of the new period is used and double weight is given to it. Thus, the Pivot Point is closer to the current market price. It also calculates four levels of support / resistance.

The formula used in the calculation of Woodie Pivot Points are:

(3) Fibonacci. The Pivot Point is calculated in the same way as in the Standard / Classical option. Additional levels are calculated based on the range of price changes over the calculated interval using Fibonacci numbers. A total of three support / resistance levels are calculated.

The formula used to calculate Fibonacci Pivot Points is:

(4) Camarilla. The Pivot Point is calculated in a standard way. Support / resistance levels are calculated based on the price range using integer coefficients. The levels are located symmetrically relative to the closing price of the settlement period. A total of four levels are calculated on each side.

The formula used to calculate Camarilla Pivot Points is:

(5) Central Pivot Range (CPR). When choosing this option, two reference levels are calculated: main and additional. The basic level is calculated using a standard formula. The additional level is calculated based on the maximum and minimum prices for the billing period.

The formula Central Pivot Range (CPR) calculation:

(6) DeMark. In this calculation, the Indicator draws a reference level and two additional ones – along one line of support and resistance. The calculation is based on the high, low and closing prices, which are given different weights depending on the position of the closing price relative to the opening price.

The formula used in calculating DeMark’s Pivot Points:

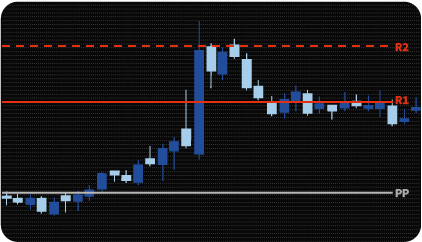

On the chart, the major Pivot Point is black and labeled “PP”, support levels are blue and labeled “S”, and resistance levels are red and labeled “R”. Each of the levels can be turned on/off in the properties window independently of other levels.

In total, the Indicator offers 4 options for selecting the data on which calculations are performed::

Thus, the Indicator can be calculated based on data from daily, weekly, monthly bars, as well as from arbitrary intervals. The start and end of these intervals are specified in hours and minutes during the day.

The MT4 Pivot Point Indicator can be used in two main types of strategies: breakout and rebound. First of all, you should pay attention to the position of the opening price of a new settlement interval relative to the main Pivot Point. The closer the opening price is to the reference level, the more likely the price is to move sideways, or flat. In this case, a strategy for a rebound from the nearest support / resistance levels can provide an advantage.

A significant distance between the opening price of a new interval and the main Pivot Point may indicate the presence of a trend. In this case, the price is likely to return to erect the Pivot Point, rebound from it and further move with a breakdown of support or resistance levels when the price moves down or up, respectively.

In addition to determining when to enter the market, the MT4 Pivot Point Indicator can be used as an aid when trading using any other strategy. In this case, the levels drawn by the indicator can be used as targets at which take profit should be placed or partial closure should be performed. These levels can also be used to set a protective stop loss order.

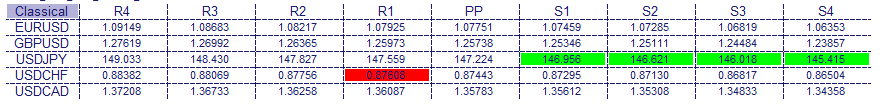

The dashboard includes all Pivot Points with prices in chosen assets.

The scanner is configured in the Indicator properties window – the symbols that need to be tracked are entered into a string variable separated by commas. All entered symbols are displayed in the table on the graphical Indicator panel: symbols are in the table rows, level values are in the columns. To quickly switch the chart to one of the monitored symbols, simply click on the line with the data of this symbol.

The scanner is configured in the Indicator properties window – the symbols that need to be tracked are entered into a string variable separated by commas. All entered symbols are displayed in the table on the graphical Indicator panel: symbols are in the table rows, level values are in the columns. To quickly switch the chart to one of the monitored symbols, simply click on the line with the data of this symbol.

When the price approaches a certain level, the corresponding table cell is highlighted in color and a notification is issued. Cells of resistance levels are highlighted in red, and support levels are highlighted in green. Notifications can be of three types: sound, text window and mobile device.

The indicator has the following parameters:

assets – selection of assets to search for signals.

max_bars – the maximum number of bars back, by which the scanner will search for signals. The parameter limits the number of calculations to speed up the indicator.

enable_alert – the option enables / disables alerts.

enable_email – allows you to send email alerts.

enable_mobile – allows you to send alerts to your mobile device.

pivot_type – choice method Pivot Point calculation : Standard / Classical, Woodie, Fibonacci, Camarilla, Central Pivot Range (CPR) and DeMark.

period_session – selecting a period for data calculation: Day, Week, Month or Custom period.

period_display_mode – setting up the display of one or more periods for calculation.

display_session_number – number of periods to display (if the “Display All Sessions” option is enabled).

trading_session – individual setting of the period for calculation (the parameter is applicable only if a custom session period is set).

display_R1- R4 / S1- S4 – individual setting of display of each support and resistance level.

We can also turn the indicator into an Expert Advisor (trading robot) with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.