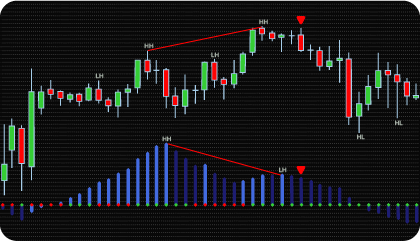

The NinjaTrader TTM Squeeze Divergence Indicator is based on the concept of the classic TTM Squeeze, which combines volatility and market pressure analysis. Unlike the standard version, however, this tool focuses on identifying divergences between price action and momentum, providing traders with a deeper view of market dynamics.

The indicator’s methodology is built on two key analytical steps:

The indicator identifies three types of divergence:

The primary purpose of the indicator is to help traders spot critical moments when price action diverges from momentum. Such discrepancies often precede turning points and allow for a more accurate assessment of whether a trend is likely to continue or reverse.

Compared to the standard TTM Squeeze Indicator, this version does more than signal market squeezes and expansions — it incorporates divergence analysis. This makes the tool valuable not only for identifying consolidation phases and breakouts, but also for assessing the strength and sustainability of ongoing moves.

In practice, the TTM Squeeze Divergence Indicator for NinjaTrader helps traders address a common challenge: recognizing when a trend is losing momentum and filtering out false signals. By combining volatility analysis with divergence detection, it provides a more reliable framework for identifying entry and exit opportunities.

The TTM Squeeze Divergence Indicator combines two powerful methods of technical analysis: volatility compression/expansion (the TTM Squeeze concept) and divergence detection between price and momentum. Understanding how these elements interact is essential for interpreting signals correctly.

The Squeeze concept

The foundation of the indicator is the TTM Squeeze setup, which measures volatility by comparing Bollinger Bands and Keltner Channels:

On the indicator panel, this state is visualized with small dots plotted on the zero line:

Integrating divergence signals

The added value of the TTM Squeeze Divergence Indicator lies in combining the squeeze signals with divergence analysis. Divergences highlight moments when price action and momentum move in opposite directions, often signaling a weakening trend or potential reversal.

Trading conditions

For a valid trade setup, three conditions should align:

When all three factors coincide, the indicator provides a structured signal that not only identifies a potential breakout but also validates its direction through divergence and momentum analysis.

The indicator has the following parameters:

Alerts – Configure various types of alerts.

Swing Strength – Defines the number of bars the indicator considers when identifying local highs and lows based on fractal logic. A higher value increases the strictness of the swing definition, as the extreme must be surrounded by more bars with lower highs (for a top) or higher lows (for a bottom). This parameter directly influences the sensitivity of divergence detection.

Max Signal Wait Bars – Defines the maximum number of bars the indicator will wait after detecting a divergence for all signal conditions to align (squeeze dots + momentum histogram rising or falling depending on signal direction).

Base Period – Number of bars used to calculate Bollinger Bands and Keltner Channel.

Bollinger Bands Std. Deviation – Standard deviation multiplier applied to Bollinger Bands.

Keltner Channel Multiplier – Multiplier applied to Keltner Channel for squeeze detection.

Divergences Settings – Configuration for enabling/disabling specific divergence types (classic, hidden, exaggerated) and customizing their visual style (line color, type, and size).

Show Swing Points – Enables or disables the display of Swing Points on the chart.

Swing Label Font Size – Adjusts the font size for Swing Point labels.

We can also turn the indicator into an Automated Trading Strategy with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

We are committed to the ongoing development and refinement of our indicators. If you’ve spotted a bug, feel that something essential is missing, or have ideas that could make the indicator even better, just send us a message. Your feedback helps us improve and deliver tools that truly meet traders’ needs.

| Signal Plot Name |

Signal Plot Values | Description |

| Momentum | Value | |

| SqueezeOn | Value | |

| SqueezeOff | Value | |

| Bearish | > 0 | SELL Signal |

| Bearish Hidden | > 0 | SELL Signal |

| Bearish Exaggerated | > 0 | SELL Signal |

| Bullish | > 0 | BUY Signal |

| Bullish Hidden | > 0 | BUY Signal |

| Bullish Exaggerated | > 0 | BUY Signal |

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.