Modern methods of financial market analysis increasingly rely on microstructural approaches, which involve studying trading participants’ behavior at the level of individual transactions and price levels. One of the key tools for such analysis is the FootPrint indicator, which provides a detailed view of buyer and seller activity within each bar.

The FootPrint Indicator for NinjaTrader is a multifunctional analytical tool designed for professional traders using the NinjaTrader platform for short-term and intraday trading. This product enhances traditional FootPrint charts by integrating additional analytical components, advanced filtering algorithms, and improved order flow visualization tools.

One of the key features of this version of the Footprint Indicator is identifying market imbalances – areas on the chart where there is a significant volume disparity between buy and sell activity at specific price levels. This represents one of the most important tools for order flow analysis, revealing the presence and activity of professional and institutional participants that often remain undetectable within traditional technical analysis.

The indicator identifies:

In practical application, recognizing imbalances provides several advantages to the trader:

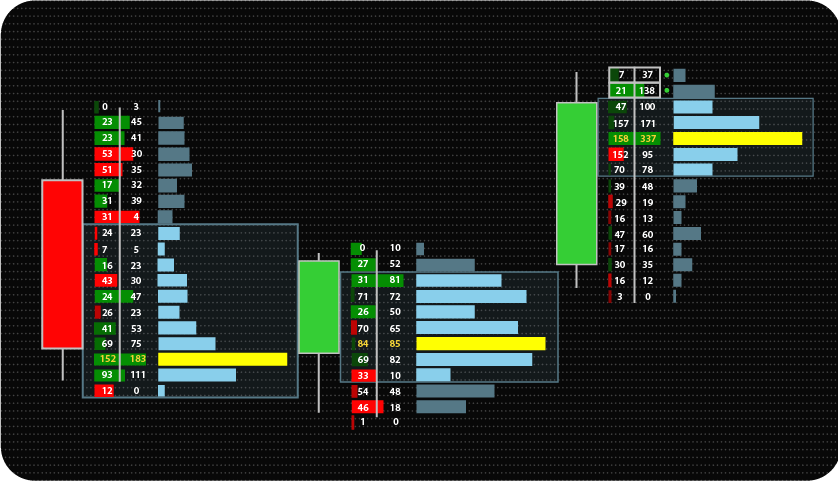

FootPrint Chart

The FootPrint chart displays the distribution of buy and sell volumes at each price level within each bar. This component helps to detect imbalances, determine market pressure from buyers or sellers, and highlight zones of large participant activity. Its main task is to give the trader a deeper understanding of the processes occurring inside each bar.

Built-in Volume Profile with POC and Value Area

The integrated Volume Profile, featuring POC (Point of Control) and Value Area levels, complements the FootPrint chart by providing insights into the horizontal distribution of volume. The POC highlights the price level with the highest traded volume, while the Value Area defines the range where the majority of trading took place. This component helps traders identify key support and resistance zones and, when combined with imbalance analysis, allows for more precise identification of areas of increased participant interest and potential shifts in market dynamics.

Imbalance Detection

The indicator detects both horizontal and diagonal imbalances, including stacked configurations, enabling timely identification of market dominance by one side.

Flexible signal filtering and alert settings are available for fine-tuning:

Summary Statistical Data

An integrated table collects the main analytical metrics for each bar:

Tick Aggregation

For instruments with high tick activity and a large number of price levels within a single bar, a tick aggregation function is provided, allowing multiple price levels to be grouped into a single print. This significantly simplifies the visual analysis of data while preserving all critical information necessary for making trading decisions.

The indicator has the following parameters:

Alerts – Configure various types of alerts.

Enable Imbalance Alerts – Enables or disables alerts for detected imbalances.

Enable Stacked Imbalance Alerts – Enables or disables alerts for stacked imbalances.

Stacked Imbalance Alert Threshold – Sets the minimum number of consecutive imbalances to trigger a stacked alert.

Show Volume Profile – Enables or disables the Volume Profile display.

Show Value Area – Enables or disables the Value Area display.

Value Area (%) – Sets the percentage range for the Value Area calculation.

Show POC – Enables or disables the Point of Control (POC) display.

Ticks Per Level – Sets the tick aggregation level for each price step.This defines how many individual ticks are combined into a single price level, simplifying the footprint view without losing essential information.

Imbalance Type – Selects horizontal or diagonal imbalance detection.

Imbalance Ratio – Defines the minimum volume ratio (e.g., 2:1, 3:1) between ask and bid (or bid and ask) to classify the condition as an imbalance.

Imbalance Min. Absolute Difference – Specifies the minimum absolute volume difference required for an imbalance to be considered valid. This helps filter out minor imbalances based on volume differences.

Statistics section – Enables or disables the on-screen display of a summary table with key trading metrics per bar. Each data point (e.g., Total Volume, Delta, Cumulative Delta, Max/Min Delta) can be toggled individually, allowing for a fully customizable statistical overview tailored to the trader’s needs.

We can also turn the indicator into an Automated Trading Strategy with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

We are committed to the ongoing development and refinement of our indicators. If you’ve spotted a bug, feel that something essential is missing, or have ideas that could make the indicator even better, just send us a message. Your feedback helps us improve and deliver tools that truly meet traders’ needs.

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.