The VWAP Indicator for NinjaTrader is a dynamic technical analysis tool designed to display the average price of an asset over a specified period, weighted by trading volume. Unlike simple moving averages, which treat all price data equally, VWAP offers a more accurate reflection of price levels where the most trading activity has occurred.

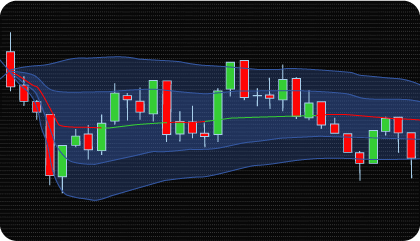

From a practical standpoint, VWAP (Volume Weighted Average Price) is widely used by traders to interpret real-time market behavior relative to traded volume. It helps identify dominant intraday trends, potential turning points, and overall market sentiment. The core concept of VWAP is simple yet effective: when price trades above the VWAP line, it typically indicates bullish sentiment. Conversely, when price is below VWAP, it suggests bearish sentiment. If price fluctuates around the VWAP line, it may signal a neutral or sideways market without a clear trend.

In addition to identifying market direction, the VWAP indicator serves as a dynamic support and resistance level during the trading session. When price approaches the VWAP line from above, it often acts as support, with buyers stepping in to defend the session’s average price. When price approaches VWAP from below, it may act as resistance, where sellers enter the market to keep prices beneath the average.

Traders frequently watch for VWAP crossovers—moments when price moves above or below the VWAP line—as these can indicate potential shifts in market sentiment or trend direction. A crossover above VWAP may suggest a bullish reversal, while a move below it can indicate a bearish turn.

The VWAP Indicator for NinjaTrader is an essential tool for intraday and volume-based analysis. It helps traders assess fair value, determine market sentiment, and identify key levels of support and resistance. Its simplicity, combined with volume awareness, makes VWAP a reliable component of any professional trading strategy.

Unlike many basic VWAP tools, the NinjaTrader VWAP Indicator stands out with several advanced features designed to address the most relevant and in-demand needs of traders. These include:

Extended Selection of Calculation Periods

Traders can apply VWAP not only to the current trading session but also to other available calculation periods, such as daily, weekly, monthly, quarterly, or yearly.

Custom Calculation Period

One of the flexible and convenient additional features of this indicator is the ability to set an exact start and end time for any custom VWAP calculation. This allows for detailed analysis of a specific calculation period that holds particular interest for the trader.

Customizable Deviation Bands Settings

The indicator supports up to three customizable standard deviation bands, which can be configured using either coefficients or percentage-based thresholds. These bands help define the boundaries of market volatility, highlight potential overbought or oversold conditions, and mark possible reversal zones.

Previous Period Levels (Historical Overlays)

VWAP lines and deviation bands from previous periods can be displayed directly on the chart. This makes it possible to track how price interacts with VWAP zones from previous periods (session, day, week, and others) — an effective way to identify hidden support and resistance areas that many traders tend to overlook.

Alerts and Signal Generation

The indicator provides customizable alerts for key events, such as price crossing the VWAP line or its deviation bands. These alerts help traders stay aware of important market movements in real time and can be integrated into automated trading systems.

Flexible Visualization Settings

Users have full control over how VWAP lines and deviation bands appear on the chart. The indicator allows detailed customization of color, thickness, style, and visibility, making it easy to adapt the visual display of its components to individual preferences and trading style.

The indicator has the following parameters:

Alerts – Configure various types of alerts.

Anchor Period – defines the VWAP calculation period. Available options include Session, Week, Month, Quarter, Year, and a Custom Period. The custom setting allows traders to specify an exact start and end time, offering greater flexibility in analyzing specific market intervals.

Show Amount of Bands – specifies how many standard deviation bands will be displayed around the VWAP line.

Bands Calculation Mode – determines the method used to calculate the deviation bands. Traders can either use standard deviation multipliers or specify these multipliers as percentages instead of traditional coefficient values.

Bands Multiplier 1 / 2 / 3 – these fields set the multiplier values for the deviation bands. For example, a value of “1” for Multiplier 1 plots a band one standard deviation away from the VWAP line.

Enable VWAP Slope-based Coloring – activates dynamic color changes for the VWAP line based on its relationship to price action: green when the price is above VWAP, and red when below. This visual cue helps traders quickly assess short-term trend direction.

Enable Bands Zones Color Fill – Enables color filling for enhanced visual context. This feature supports two modes: Standard fill, which consistently colors the area between the VWAP line and its deviation bands, and Bullish/Bearish fill, which dynamically fills the area between the price and VWAP—green when the price is above VWAP and red when it is below—highlighting prevailing market sentiment.

Enable VWAP Crossover Signals – activates signals when the price crosses the VWAP line.

Enable Bands Crossover Signals –turns on signals when the price crosses any of the deviation bands.

Show Previous Period Levels – displays the VWAP line and its deviation bands from previous periods.

We can also turn the indicator into an Automated Trading Strategy with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

We are committed to the ongoing development and refinement of our indicators. If you’ve spotted a bug, feel that something essential is missing, or have ideas that could make the indicator even better, just send us a message. Your feedback helps us improve and deliver tools that truly meet traders’ needs.

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.