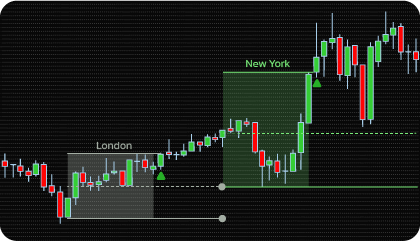

The ICT Kill Zones methodology is one of the most effective approaches for identifying periods of heightened market activity. It is based on the observation that the largest price movements often occur around the opening of major trading sessions. During these times, liquidity flows into the market, the balance between participants shifts, and conditions for impulsive moves are created.

The NinjaTrader Kill Zones Indicator is an analytical tool designed for traders who apply the ICT Kill Zones concept and want to pinpoint the most active periods in the market with precision. The indicator not only highlights standard trading sessions (Asian, London, and New York) but also allows you to create fully customizable time zones with minute-by-minute accuracy, personalized labels, and background colors.

A key feature of this tool is the integration of Kill Zones and Pivots. You can display session Pivot levels, the session midpoint, and the Day Open level. There is also an option to extend Pivot levels until the start of the next equivalent session, which is especially useful for analyzing price action between session periods.

The core purpose of the indicator is to help traders clearly see the most active and liquid phases of the market, when the probability of significant price movements is at its highest. This enables more precise trade planning, better timing of entries and exits, and avoidance of low-volatility periods.

In ICT Kill Zones methodology, these active market phases are tied to the openings of the world’s key trading sessions:

The NinjaTrader Kill Zones Indicator automates the application of this methodology, removing the need for constant manual tracking. It highlights these time windows directly on the chart and combines them with price level analysis (Pivots, midpoints, Day Open), so you always know whether the market is in a quiet phase or in an active impulse.

By incorporating Kill Zones into your trading, you gain two main advantages:

The NinjaTrader Kill Zones Indicator stands out with several advanced features specifically designed to meet the most relevant and practical needs of traders using Kill Zones in their trading. These features include:

Trading Session Customization

Predefined session mapping allows traders to highlight Asia, London, and New York trading periods directly on the chart, each with its own label, start/end time, and background color, providing clear visual segmentation for time-based strategies.

Custom Session Addition

User-defined session blocks let traders create custom time intervals with unique labels, start/end times down to the minute, and personalized background colors. This enables precise focus on market segments beyond standard sessions and makes specialized strategies more accessible and manageable.

Session-Based Reference Lines

Intraday pivot analytics display horizontal price levels that reflect session highs, lows, and midpoints, along with the day’s opening price. These benchmarks help traders gauge market bias and potential price reaction or movement points.

Extended Pivot Projection

Extends session pivot levels into the next equivalent session, allowing traders to monitor and analyze inter-session price trends and key levels more effectively for improved trade planning and decision-making.

Alerts and Signal Generation

Enables flexible notification settings and the option to show or hide signals on the chart, ensuring traders can react promptly to important activity within Kill Zones. These signals mark Kill Zone breakouts, helping traders identify key entry points.

The indicator has the following parameters:

Alerts – Configure various types of alerts.

Session Enabled – toggle the display of the session on the chart on or off.

Name Session – assign a custom name to the session for easy identification.

Start and End Session (EST) – set the precise start and end time of the session down to the minute.

Color for Session – choose the background color for the session zone.

Opacity for Session – adjust the transparency of the session background in percent.

Enable Kill Zone Pivot – toggle the display of session pivots (High and Low) on or off.

Enable Kill Zone Middle Pivot – toggle the display of the midpoint line between the High and Low pivots.

Extend Kill Zone Pivot – extend session pivot lines to the next equivalent session.

Show Pivot Labels – display or hide pivot labels on the chart.

Enable Buy/Sell Signals – enable or disable trading signals.

Day Open Price Pivot – show or hide the day’s opening price pivot, with options to customize name, start time, color, and line style.

Session Drawing Limit – define how many past consecutive sessions to display on the chart.

Label Font – adjust the font size for session names and pivot labels for clarity.

We can also turn the indicator into an Automated Trading Strategy with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

We are committed to the ongoing development and refinement of our indicators. If you’ve spotted a bug, feel that something essential is missing, or have ideas that could make the indicator even better, just send us a message. Your feedback helps us improve and deliver tools that truly meet traders’ needs.

| Signal Plot Name |

Signal Plot Values | Description |

| KillZoneStart | Value | |

| KillZoneEnd | Value | |

| KillZoneBullishPivotEnd | Value | |

| KillZoneBearishPivotEnd | Value | |

| KillZoneMiddlePivotEnd | Value | |

| Long | > 0 | BUY Signal |

| Short | > 0 | SELL Signal |

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.