The NinjaTrader Gann High Low Indicator is a technical analysis tool designed to track short-term price direction based on the evaluation of extreme price levels.

Built on the classic principles of Gann methodology, the indicator identifies key price zones using historical highs and lows. Its core concept involves calculating a moving average based on these extremes over a defined period, allowing traders to highlight trends and potential reversal points.

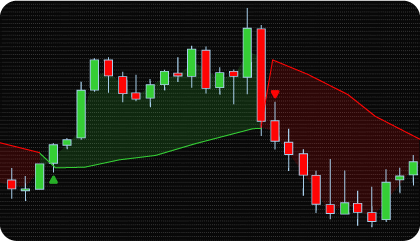

The indicator plots directional lines on the chart that reflect prevailing market sentiment. It is used to detect local reversals, refine entry and exit points, and generate signals aligned with the dominant trend. The main objective is to provide a visual framework for assessing current market phases with minimal delay.

Unlike standard versions, the NinjaTrader Gann High Low Indicator offers a set of optional signal filters that can be activated individually or in combination. This flexibility enables deeper market analysis and adaptation to various trading methodologies.

The customizable filters help reduce false signals in conditions of low volatility or liquidity, enhancing the quality of signal interpretation. The indicator performs effectively in both trending markets and during corrective phases, where confirmation through additional analytical tools is particularly important.

Designed to operate under diverse market conditions—from strong directional movement to sideways consolidation. The combination of core logic and flexible filters supports a systematic approach to analyzing market structure using multiple confirming factors.

The core element of the Gann High Low Indicator is its indicator line, which functions as a moving average calculated based on the highs or lows over a specified period. This line is displayed on the price chart and serves as a reference for identifying the current market trend.

The primary function of the line is trend identification: when the price is above the line, it indicates an upward trend; when it is below, it signals a downward trend. In addition to the standard moving average used in the classic version of the Gann High Low Indicator, this version supports alternative calculation methods, including EMA, HMA, KAMA, T3, and WMA, allowing for greater adaptability to different trading approaches and market conditions.

The indicator can be used either as a standalone tool or in combination with additional signal filters. All filters can be enabled individually or simultaneously. The following types of filtering are supported:

Higher Timeframe Trend Filter

Used to confirm signals on a lower timeframe in the context of the trend direction on a higher timeframe.

Example: If the Gann High Low line on the H4 chart indicates an uptrend, only buy signals on the H1 chart are considered.

Moving Averages (SMA, EMA, HMA, KAMA, T3, WMA)

Applied to smooth price data and highlight the prevailing direction of movement.

Example: Buy signals are considered valid only if the price is above the 200-period moving average, confirming an uptrend.

ATR (Average True Range)

Assesses the current level of market volatility and is used to filter signals during periods of low activity.

Example: When ATR is low, the probability of trend continuation decreases, and signals may be disregarded.

RSI (Relative Strength Index)

Used to evaluate overbought or oversold market conditions.

Example: If the RSI exceeds 70, buy signals from the Gann High Low line may be filtered out until a pullback occurs.

MACD (Moving Average Convergence Divergence)

Used to confirm trend strength and assess current momentum.

Example: Entry signals are validated when the indicator line and MACD histogram align in direction.

Each filter includes a separate configuration block for fine-tuning. Filters can be applied in two modes: either by checking conditions at the exact moment a signal appears, or by using delayed confirmation — where a signal is activated only after filter conditions are met. This approach provides flexibility in adapting the indicator’s behavior to different trading styles and market conditions — from highly volatile trends to consolidation phases with limited liquidity.

The indicator has the following parameters:

Alerts – Configure various types of alerts.

Use Delayed Confirmation – enables or disables delayed confirmation for signal filters. When active, the indicator waits for filter conditions to be met before validating the signal.

Gann Moving Averages Type – specifies the type of moving average used to construct the Gann High Low line. In addition to the classic simple moving average (SMA), other supported options include EMA, HMA, KAMA, T3, and WMA.

Gann High / Low Period – defines the periods for Gann High and Low calculation

Use Higher Timeframe – activates the Higher Timeframe Trend Filter, which checks the trend direction on a selected higher timeframe to validate signals on the current chart. Options: Custom selection of the higher timeframe (e.g., H4 when trading on H1).

Use Moving Averages – enables the Moving Averages Filter. The user can choose from various moving average types — SMA, EMA, HMA, KAMA, T3, WMA — and set the period for trend confirmation.

Use ATR – activates the ATR Filter, which helps assess market volatility. The parameter includes the ATR period and a threshold level. Signals are only considered valid if ATR exceeds the defined threshold.

Use RSI – enables the RSI (Relative Strength Index) Filter. Parameters include the RSI calculation period and the overbought/oversold thresholds.

Use MACD – enables the MACD filter with customizable periods and options to use the MACD line, the signal line, or both for validating signals in line with the Gann High Low direction.

We can also turn the indicator into an Automated Trading Strategy with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

We are committed to the ongoing development and refinement of our indicators. If you’ve spotted a bug, feel that something essential is missing, or have ideas that could make the indicator even better, just send us a message. Your feedback helps us improve and deliver tools that truly meet traders’ needs.

| Signal Plot Name |

Signal Plot Values | Description |

| HiLo | Value | |

| Long | > 0 | BUY Signal |

| Short | > 0 | SELL Signal |

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.