NinjaTrader EMA Cloud Trend Following Indicator is built on the fundamental concept of market analysis through the interaction of moving averages. At its core lies the comparison of two Exponential Moving Averages (EMAs) — fast and slow. Their relationship reflects the balance between short-term and medium-term price dynamics: when short-term momentum prevails, the fast EMA is positioned above the slow EMA, creating a bullish background; when the opposite occurs, the market shifts into a bearish phase.

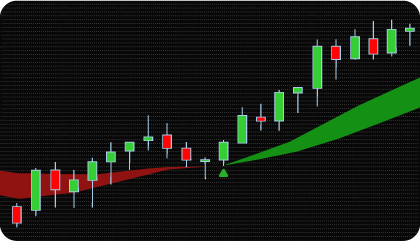

The cloud formed between the two EMAs serves as a clear visualization of the trend. A change in its color highlights the transition of dominance from buyers to sellers and vice versa. For traders, this is more than just an indicator display — it is a tool for structuring market observations: identifying sustained impulses, tracking phase shifts, and filtering out the inevitable noise present on price charts.

The core idea of the method lies in applying a simple yet effective mechanism to define the direction of the trend. Instead of individual moving average lines, the trader observes an integrated zone that reflects not only momentum but also its sustainability.

The indicator belongs to the category of trend-following tools and addresses the task of identifying the market’s current state — trending or counter-trending. This approach enables traders to analyze price action within the logic of sequential phases: upward movement, downward movement, or transitional periods when a directional shift is forming.

EMA Cloud Trend Following Indicator helps traders identify market direction by analyzing two moving averages: a fast one and a slow one. On the chart, a cloud forms between them, with its color reflecting the prevailing trend:

The change in the cloud’s color is a key signal from the indicator, marking a transition from one market phase to another.

Second Cloud as a Filter

The indicator also supports an optional second cloud with longer EMA periods. This second cloud acts as a filter for the primary cloud.

Signals are only confirmed when the colors of both clouds align. This combination reduces false signals and helps traders focus on more stable and reliable trend movements.

Additional Features: Choice of Moving Average Type

EMA Cloud allows traders to select the type of moving average used: EMA, SMA, HMA, or KAMA.

This flexibility allows traders to choose the optimal moving average type based on their trading style and signal sensitivity preferences.

The indicator has the following parameters:

Alerts – Configure various types of alerts.

Moving Averages Price Type – selection of the price used for moving average calculation: OPEN, HIGH, LOW, CLOSE, HL2, HLC3, OHLC4.

Moving Averages Type – configuration of the moving average type: EMA, SMA, HMA, or KAMA, determining signal smoothing and sensitivity.

MA Fast/Slow Period – setting the periods for fast and slow MAs to define short- and medium-term trends.

Cloud Offset – cloud position offset relative to price on the chart.

Enable Alerts – activation of notifications when the cloud changes color or signal conditions are met.

Show Signals – visual display of entry points on the chart based on cloud color changes.

Enable Cloud2 as Filter – use of a second cloud to confirm signals; signals are considered only when both clouds share the same color.

Cloud2: Max Wait Bars – maximum number of bars to wait for a second cloud color change to confirm a signal.

We can also turn the indicator into an Automated Trading Strategy with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

We are committed to the ongoing development and refinement of our indicators. If you’ve spotted a bug, feel that something essential is missing, or have ideas that could make the indicator even better, just send us a message. Your feedback helps us improve and deliver tools that truly meet traders’ needs.

| Signal Plot Name |

Signal Plot Values | Description |

| Long | > 0 | BUY Signal |

| Short | > 0 | SELL Signal |

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.