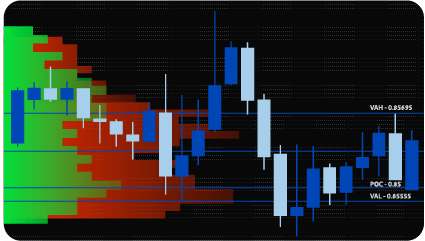

Volume Profile is an advanced charting method that reflects trading activity (volume) accumulated over a given time period at specific price levels. The tool plots a histogram on a chart designed to identify dominant or significant price levels based on volume at price over a specified time period. The Volume Profile divides the total trading volume at a given price level over a specified time period by the total buying or selling volume over the same period. It then visualises and displays this information as a histogram, making it easily visible to the trader.

There are many trading strategies that use the Volume Profile as a key component. Typically, many traders use the tool precisely to determine the main support and resistance levels. To do this, traders rely on past price movements, volume behaviour and analyse them. This approach is useful because it helps determine the significance of price levels that the market has already been at.

The Volume Profile indicator is plotted on the asset chart. This approach makes it possible to visually see the market as a whole, identifying the most conceivable currency pairs and timeframes for trading.

There are several options for finding market entry points:

Essentially, Volume Profile zones can be interpreted as zones of resistance and zones of support. The green colour of the diagram shows the volume of deals that the buyers have converted, and the orange one – the deals of the sellers.

There are several important levels to pay attention to when viewing the volume profile chart:

The Volume Profile Indicator has three input parameters:

The Volume Profile Indicator assumes a choice of one of the two parameters – Volume and TPO.

The calculation with the Volume parameter assumes that the ranges and POCs are formed based on the volume. The time that the price spends at certain levels is not counted.

Calculation with the TPO parameter implies that the zones of values and POC are formed based on time and price. Volumes are not taken into account in this option.

We can also turn the indicator into an Expert Advisor (trading robot) with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.