MT4 Support and Resistance Zones indicator is a special tool that allows to identify major support and resistance zones at which the price tends to bounce or to perform a massive breakout generating a strong momentum. The zones can be identified based on how the price behave around some levels/ranges.

The price will bounce from a zone and then will break it with a significant price movement providing opportunities for speculative trading.

The indicator allows you to visualize the market key levels, at which the price has stopped in the past pretending that such stop was not a coincidence. The more stops (touches) there are – the more significant the zone is.

We have designed this indicator in a form of a dashboard in order to allow you to visualize the nearest zones and their related strengths across currencies and timeframes that interests you in your trading. Such approach provides the ability to see the market in a glance identifying the most potential pairs and timeframes to trade.

There are 2 main types of entries that you may execute using this indicator – a bounce trade and a breakout trade.

The bounce trade is taken when he price bounces back from a zone allowing you to trade the retracement. While if the price breaks through the zone, most probably it will continue to rally beyond the just broken zone providing the opportunity for a breakout trade.

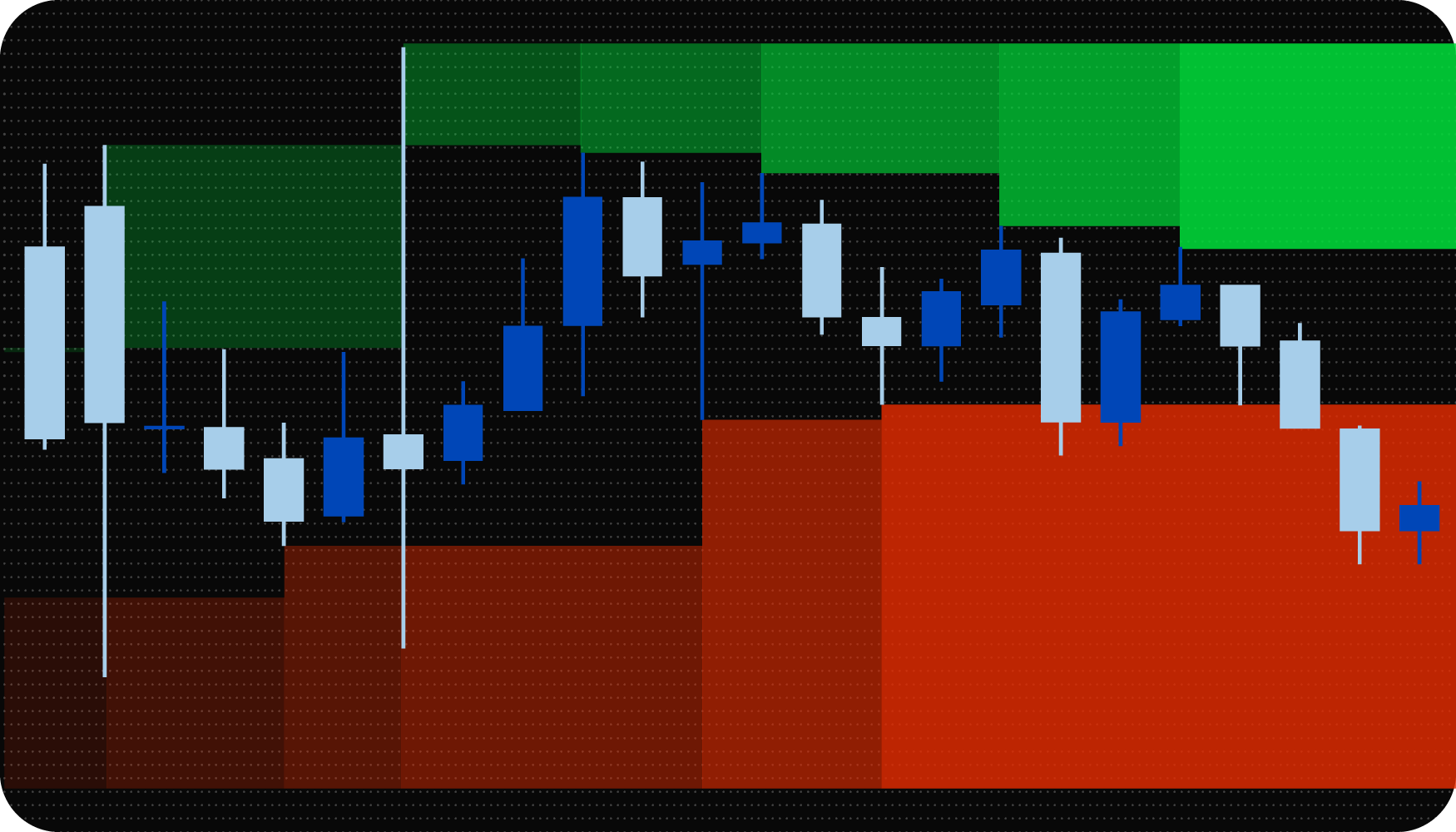

Basically, the indicator draws Support and Resistance zones across the market – red for Support (below the market) and green for Resistance (above the market). Zones are changing during the time in terms of size and strength. They can widen (often) or narrow (rarely); they can become stronger or lose some of their power and become weaker.

While the size of a zone is self-explanatory, the strength is represented by a color. The stronger the zone is, the darker its color would be. You can check the zone strength by hovering a mouse over it. The weakest zones have strength around 1-2, the zones of a middle strength are 3-5 and the strongest zones have 6-10 strength index (it can be even more in rare cases).

The stronger and the wider the zone, the more probable the price will bounce of it. But if the price breaks such zone, the momentum may increase very significantly in a short period of time.

The dashboard allows you to see the market in a glance in relation of S/R zones located on different currency pairs and timeframes.

Each currency pair/timeframe cell contains 2 boxes – green and red. The green box contains the information about the nearest Resistance zone located on the related chart, while the red box – about the nearest Support zone. The info in each box is designed in the following format:

X – Y pips

Where X is the strength index of the nearest Support/Resistance zone on the related chart and Y – is the amount of pips the zone is located away from the current market price. This allows you to select the chart that worth your attention now (in case you see a zone with a high strength located very close to the current market price, for example).

The indicator input parameters are pretty straightforward and self-explanatory. It allows you to select the currency pairs and timeframes that you want to monitor. Parameter “max_bars” limits the amount of calculations in order to speed up the indicator in case you do not need it to calculate zones too far in the past.

We can also turn the indicator into an Expert Advisor (trading robot) with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.