MT4 TDI (Traders Dynamic Index) Indicator combines RSI indicators that determine the strength of the current trend, Moving Average, showing the prevailing direction of the trend, and Bollinger Bands, defining the range of price fluctuations that characterises market volatility. The use of indicators in this combination allows the trader to receive the most accurate signals for opening positions.

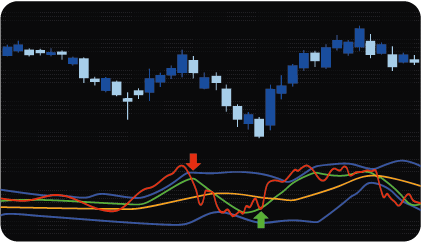

The main lines of the indicator are red (signal line) and green (price line / fast line). Both of these lines represent the smoothed value of the RSI indicator. The signal line has a longer smoothing period than the price line.

Bollinger Bands are represented by three lines: the orange line (Moving Average), the middle line between the upper and lower borders of the channel and two blue lines (upper and lower channel borders), which are also moving averages, but shifted by several standard (root mean square) deviations.

Gray (dash-dotted) lines show the boundaries of the overbought and oversold zones.

First of all, the indicator can be used to determine the current trend direction. The green line above the orange one signals a trend change to an uptrend. When green falls below orange, the trend changes to a downtrend.

Secondly, the indicator warns about the beginning of a new trend. For example, if the red line crosses the green one from the bottom up, then this indicates the beginning of an upward trend. Conversely, the intersection from above to down speaks of the beginning of a downward trend.

The indicator also signals the current strength of the market – the greater the slope of the green line, the stronger the price movement. If this line is horizontal, then the market is flat. The expansion of the channel lines indicates an increase in volatility. The narrowing of the lines indicates a decrease in volatility and a weakening of market activity. The exit of the red (signal) line beyond the boundaries of the channel with a high degree of probability indicates an approaching trend reversal.

One of the features of this indicator is the built-in information panel (dashboard). Using the dashboard, the trader can see the found indicator signals on all selected trading instruments and timeframes. The dashboard allows you to switch to the desired chart in one click, which allows the trader to quickly assess the market situation and make a decision to open a trade.

The indicator is equipped with a convenient notification system (alerts). Beyond pop up messages, the trader has the ability to send messages to email and mobile devices.

The indicator has two main modes for trading signals.

PRICE_LINE_CROSS. In this mode, signals are generated when the signal line (red) and the price line (green) cross. If the signal line crosses the price line from the bottom up, then a BUY signal appears. On the contrary, the signal crosses the price line from top to bottom – a signal to SELL. Additional conditions for the occurrence of signals: the lines crossed in the overbought / oversold zones, and until that moment the red (signal) line went beyond the borders of Bollinger Bands.

BAND_LINE_CROSS. In this mode, the intersections of the signal line (red) and the middle of the channel (orange) are used. When the signal line crosses the middle of the channel from bottom to top, then a BUY signal appears. If the signal line crosses the middle of the channel from top to bottom, then the indicator gives a SELL signal. Additional conditions are also met: the lines crossed in the overbought / oversold zones, and until that moment the red (signal) line was going beyond the borders of Bollinger Bands.

Overbought / oversold zone parameters are adjusted in the indicator settings. There is one important rule to keep in mind when configuring parameters. Too high values of the overbought zone will make the signals more accurate, but less frequent, and too low values will increase the frequency of the signals, but reduce their accuracy. Thereafter, everything works in reverse for the oversold zone.

The dashboard shows information about the current status of detecting signals.

The cell of the asset / timeframe contains information about the direction of the trade (BUY or SELL) and the serial number of the bar (the number of bars back) on which the signal was detected.

The color of the cell indicates the direction of the trade (BUY – green, SELL – red) and changes the saturation of the main color depending on how much the distance of the bars from the last bar on which the signal was detected increases.

The dashboard allows traders to easily and fastly choose the assets they want to work with by clicking on a particular cell in the dashboard.

The indicator has the following parameters:

assets – selection of assets to search for signals.

enable_M1 – enable_MN – include / exclude timeframes (from a minute to a month) to search for signals via them.

max_bars – the maximum number of bars back, by which the scanner will search for signals. The parameter limits the number of calculations to speed up the indicator.

enable_alert – the option enables / disables alerts.

enable_email – allows you to send email alerts.

enable_mobile – allows you to send alerts to your mobile device.

applied_price – is a choice type prices for calculations (OPEN, HIGH, LOW, CLOSE, HL2, HLC3, OHLC4).

ma_method – Moving Average method.

rsi_price_line_period – period for calculating the price line / fast RSI line.

rsi_signal_line_period – period for calculating the RSI signal line.

band_deviation – standard deviation multiplier of Bollinger Bands.

overbought_level – overbought level values.

oversold_level – oversold level values.

signal_mode – selection of the indicator signal mode.

We can also turn the indicator into an Expert Advisor (trading robot) with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.