MT4 RSI Divergence Indicator (Scanner) is a special tool that automatically performs market analysis on all assets and timeframes designated by a trader to detect classic and hidden divergence of the RSI indicator.

Divergence is one of the most powerful technical analysis tools. Traders use divergence to dramatically improve the accuracy of predicting a reversal or trend continuation and to make an informed decision on where to enter the market.

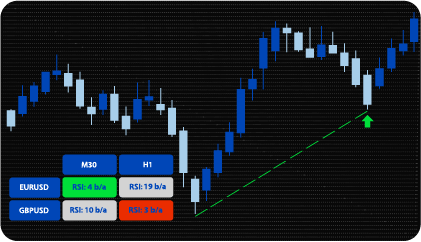

We have designed this indicator as a dashboard so that you can visualise the most recent divergences between assets and timeframes that interest you in your trading. This approach makes it possible to see the market at a glance, identifying the most promising pairs and timeframes for trading. For a quick reaction to a detected signal – the dashboard provides a transition to the desired chart in one click.

You can set up an alert that will notify you every time a divergence occurs, without having to spend hours in front of the screen.

Divergence is a discrepancy between what the price chart shows and the trend line of the indicator itself. Correctly identifying these mismatches will help you determine when the price will start to fall and when it is likely to rise.

Traders use divergence to evaluate the likelihood of a price reversal.

Divergence between the asset price and the RSI indicator can imply two situations:

Divergences are divided into two types – bullish and bearish.

Bearish RSI divergence occurs when price forms a sequence of highs in an uptrend, while the RSI does not follow that trend and forms a bearish trend-line.

When the price on the chart rises and the RSI value falls, the price growth can be expected to come to close. This is a signal to sell ↓ (short) trade.

A bullish RSI divergence will form as prices form a series of clear lows in a downtrend, and the RSI does not confirm this by creating a bullish trend-line. This is an early warning signal that the direction of the trend could change from a downtrend to an uptrend.

When the value of an asset falls and the RSI rises, this could be a signal that the market will bounce and the price will go up. This is a signal that it is worth opening a buy ↑ (long) trade.

The indicator displays the identified divergences in the form of lines connecting pairs of price and indicator peaks, as well as entry arrows that show the proposed direction of trade. The green arrows are for buying (long) trades, and the red arrows are for selling (short) trade. Bullish divergence is shown as a green line, while a bearish divergence is shown as a red line.

The indicator detects two types of divergences: classic and hidden. If the divergence is classic, the line will be continuous, and if it is hidden, the line will be dashed.

Please note that since divergences are identified using formed indicator vertices, the arrow will appear 2 bars back as a formed vertex is defined as:

The Dashboard allows you to quickly see the market in relation to RSI divergences identified across different assets and timeframes:

Each cell of an asset / timeframe contains several blocks, each of which shows the most recent divergence found on the chart of that particular asset / timeframe

The colour of the field indicates whether the divergence was bullish or bearish – the higher number of bars ago the pattern was identified, the paler the cell colour will be. This allows you to choose the most suitable chart for trading.

Clicking on the corresponding cell will change your chart to the asset and timeframe of the selected cell.

The indicator input parameters are quite simple and do not require any additional explanation.

It allows you to select the assets and timeframes that you want to track.

The “max_bars” parameter limits the number of calculations in order to speed up the indicator, if you do not need it to calculate divergences too far back in the past.

In the indicator settings, you can select the parameter for displaying classic and hidden divergences.

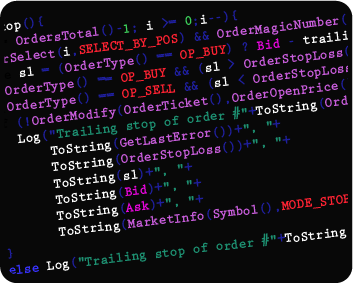

We can also turn the indicator into an Expert Advisor (trading robot) with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.