Camarilla Pivot Points indicator draws support and resistance lines based on special calculations. This technical analysis tool includes alerts, dashboard. Traders can easily switch to signals from the dashboard in one click. This indicator also includes flexible settings allowing you to set various functions on your own.

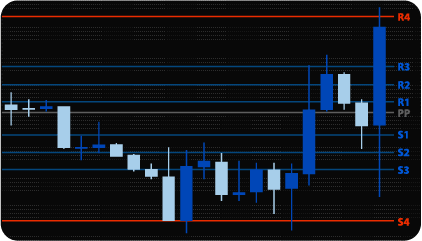

The equations are used to calculate intraday support and resistance levels using previous days volatility spread. Current levels are calculated on the previous day’s high, low and close. The indicator includes 8 levels of intraday support and resistance and the PP level in the middle. Most important are S3, S4 and R3, R4. THe last resistance and support levels can be considered as trend holding areas. Once they are broken out or down, traders can follow the trend.

Unlike many other types of PP (Pivot Points), this one includes four resistance (R1-R4) and four support (S1-S4) levels. Below you can find the calculation of Camarilla Pivot Points:

R4 = CLOSE + (( HIGH – LOW ) x 1.1 / 2 );

R3 = CLOSE + (( HIGH – LOW ) x 1.1 / 4 );

R2 = CLOSE + (( HIGH – LOW ) x 1.1 / 6 );

R1 = CLOSE + (( HIGH – LOW ) x 1.1 / 12 );

PP = ( HIGH + LOW + CLOSE ) / 3;

S1 = CLOSE – (( HIGH – LOW ) x 1.1 / 12 );

S2 = CLOSE – (( HIGH – LOW ) x 1.1 / 6 );

S3 = CLOSE – (( HIGH – LOW ) x 1.1 / 4 );

S4 = CLOSE – (( HIGH – LOW ) x 1.1 / 2 );

There are several trading strategies that one can use when dealing with Pivot Points. They are designed for various trading styles including intraday and even scalping.

This strategy can be applied when the price breaks out or down one of the Pivot Point levels. When the price surges and goes above one of the resistance levels, you can open long trades.

As for risk management, Stop Loss can be placed either below this resistance level at the previous bottom or a certain distance if you use a mathematical approach to risk calculations.

If you use Take Profits, you can one at the next resistance level. To let the profit grow, traders can also use Trailing Stops. There is no need in the Take Profit order in this case, the trade will be closed automatically when the price touches the Trailing Stop level or you can fix it manually.

When it comes to a downtrend, the Camarilla levels indicator allows traders to place short trades once the price breaks down a certain level. The Stop Loss can be placed above this level at the previous top or a certain distance if you use a mathematical approach to Stop Loss calculations.

Keep in mind that you can set the alerts for the broken levels. This will help you to engage timely. You don’t need to follow the market constantly.

Sell when the price is above R3 and breaks this resistance down. Target levels are S1, S2 and S3 in this case. Stop Loss can be placed at R4. When the price is below S3 level and moves higher, buy orders are actual. Target levels will be R1, R2 and R3 in this case. Stop Loss can be placed at S4.

If the price moves above R4, you can buy the asset with the following targets – 0.5%, 1%, 1.5%. Stop Loss can be placed at R3.

When the price falls below S4, the same is possible with the sell order targeting 0.5%, 1% or 1.5%. Stop Loss should be placed at S3 in this case.

Pivot Points can also be used to find reversal points. When the price is close to the R4, for example, it is a good moment for the trader to prepare short trade. Once the price has bounced, you can sell.

Stop Losses are placed above the R4 resistance in this example. You can calculate them manually using a mathematical approach or place them slightly above the closest high.

As for the Take Profits, they can be placed at the closest resistance level. If the price plunges strongly, you can remove your Take Profit order and place it at the next lower resistance. Trailing Stop is also helpful in this case. By using it, you can follow the whole downtrend and maximize your eventual profit.

When the downtrend is over, the price may reverse upwards. Camarilla Pivots indicator allows traders to find those reversal levels to open long trades. The stronger signal comes when the price is close to the S4 level.

Stop Loss can be placed below the support line at the closest low or a certain distance if you use a mathematical SL calculation approach.

As for the profit, you can follow the trend or place a Trailing Stop order to earn more. As it was with short signals, long ones are also stronger.

When the price is close to R4 and is unable to break it out, place a sell order. Targets will be S1, S2 and S3. Stop loss should be above R4. If the price is close to S4 and is unable to break this level down, it is recommended to open the buy order. Stop loss can be placed below S4.

Camarilla Pivot Points indicator can also be used to determine market trends. If the price resides below the PP level, it is assumed to be the downtrend as the Bears’ pressure is very high at that moment. The Pivot Point can be considered as a kind of frontline between the Bulls and Bears. Once the price rises above the PP, market sentiment changes, and Bulls take control over the market.

Once the price breaks out the PP level, you can place long orders targeting R1, R2, R3 or even R4 as Bulls are dominating the market. In cases when the price breaks down the PP level, traders can place short orders targeting S1, S2, S3 and S4. Stop Loss can be placed above PP.

Camarilla Pivot indicator can also be used as an exit algorithm. If the price is close to any resistance level and unable to move higher, you can fix your long positions as there is a probability that this resistance level will prevent the asset from developing the uptrend.

This indicator may also be used to exit short positions when the price is stuck at any support level. If this happens, the chances for the asset price to reverse are higher. Closing short trades at those points is a reasonable solution.

The dashboard includes all pivot points with prices in chosen currencies/assets.

Dashboard indicates the moments when the price breaks out or breaks down all drawn lines. When they are colored in green, this is a strong buy signal. Red-colored levels mean a strong sell signal. If the color of the cell becomes paler, the signal loses its strength. For example, a pink cell means that it is not a good moment to sell an asset. If you click any asset cell, you will be transferred to the appropriate chart.

If you need a couple of currency pairs to be followed, you can indicate them in the assets section. There are three of them in our example but you can add/remove any asset that is provided by your broker.

The trading session point allows you to change the time of PP recalculation. Along with the max bars, this will help you to set up your strategy.

Max_bars parameters limits the number of bars that are included into the calculations. If you want to get the results faster, you need to decrease the number of bars to count.

Users can switch on/off notifications and choose between email or/and mobile devices notifications.

We can also turn the indicator into an Expert Advisor (trading robot) with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.