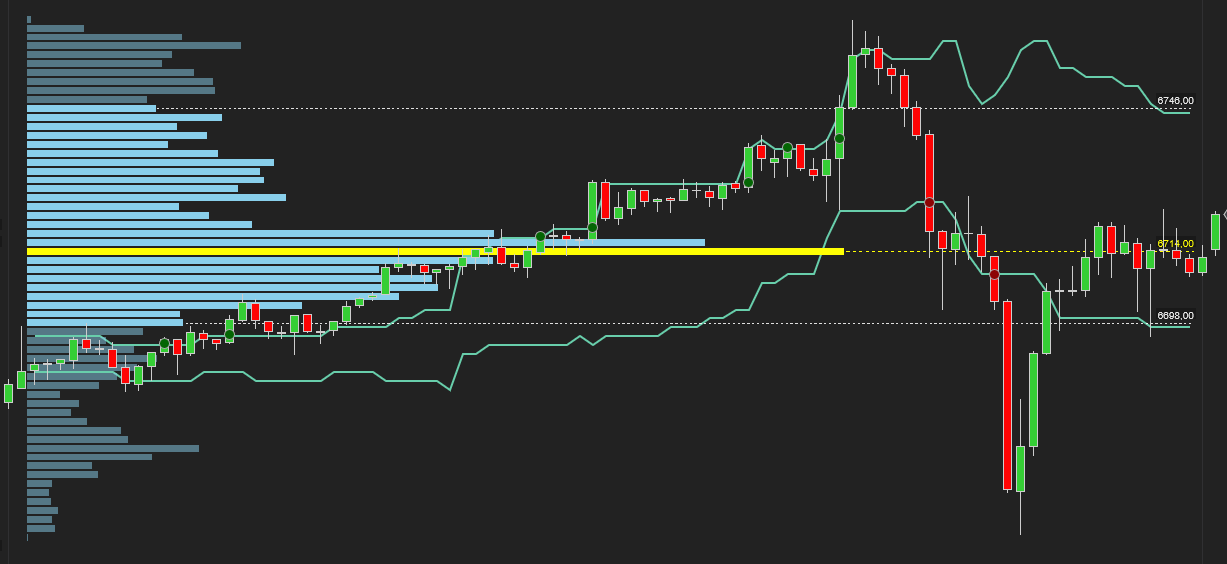

NinjaTrader Intraday Value Area Breakout Indicator is designed to analyze and track breakouts of Value Area High (VAH) and Value Area Low (VAL) within the current period — such as a session, day, week, or a custom-defined time range.

The indicator visualizes the evolving Value Area, displays the Volume Profile, and detects breakout signals of VAH and VAL levels in real time. Unlike approaches based on previous-period levels, this tool works with the current market structure, allowing traders to observe how Value Area zones shift and develop as the session unfolds.

Volume distribution across price levels reflects the balance of power between buyers and sellers. One of the key elements of the Volume Profile is the Value Area — the price range that contains roughly 70% of the total traded volume for the selected period.

The Value Area consists of:

These levels indicate where most trading activity has taken place. When price moves beyond VAH or VAL, it often signals a transition from balance to directional movement. Breakouts through these levels frequently mark the beginning of intraday impulses or short-term trend shifts.

Value Area Breakout Indicator for NinjaTrader identifies the exact moments when price first crosses the current VAH or VAL levels. Unlike static levels from previous periods, current VA levels are calculated dynamically as volume accumulates during the session.

Such breakouts reflect intra-session changes in supply and demand structure and allow traders to detect shifts in market context as they happen.

With this indicator, traders can observe:

Analyzing the current Value Area makes it possible to identify impulses and volume redistribution in real time. A breakout of VAH or VAL during the current period may indicate:

Value Area Breakout Indicator is an analytical tool that helps pinpoint where, within the current period, the market begins to change its state. It does not predict future movement but identifies the transition from balance to impulse — a critical phase where new intraday trading opportunities often emerge.

The NinjaTrader Intraday Value Area Breakout Indicator allows traders to track and interpret breakouts of the current period’s Value Area, providing valuable insights into how volume distribution evolves and where new directional moves are forming.

The NinjaTrader Intraday Value Area Breakout Indicator provides practical and flexible tools, allowing traders to adjust settings for different trading styles and market conditions. These features include:

Breakout Detection Modes: Live and Locked

The indicator supports two breakout detection modes — Live and Locked. Each mode uses its own signal logic and is suited for different trading styles.

In both Live and Locked modes, a new breakout signal can only occur if, after the initial breakout, price fully returns back inside the Value Area and then breaks out again.

Live Mode — Detecting Breakouts on the Current Bar

In Live Mode, the indicator identifies a VAH or VAL breakout the moment it happens — on the current bar. Signal markers appear instantly when price crosses the level. However, if VA levels shift during the formation of the same bar (for example, VAH or VAL move as the profile updates), the signal may disappear.

Live Mode is designed for immediate detection of intraday breakouts, enabling traders to react to emerging movements without delay. This makes it especially valuable for aggressive strategies and scalping.

| Advantages | Characteristics |

| Fast reaction to changes in market structure | Signals may be less stable due to real-time VA adjustments |

| Ability to enter early, at the start of a potential impulse | Some breakouts may fail if price quickly returns into the Value Area |

| Well-suited for active intraday traders | Works best with additional filters (e.g., volume or threshold) |

Locked Mode — Breakouts Based on Fixed VA Levels of the Previous Bar

In Locked Mode, breakouts are determined using VAH and VAL levels fixed on the previous bar. Unlike Live Mode, where levels can shift as the bar develops, Locked Mode relies on static values, making breakout detection more stable and eliminating the “floating level” effect.

Locked Mode is ideal when traders prefer to work with clearly defined, non-changing levels rather than dynamically updating ones. This approach produces more consistent and reliable signals, particularly during periods of active profile development.

| Advantages | Characteristics |

| Fixed VAH/VAL levels prevent signal redefinition when the profile adjusts | Signals are generated from static previous-bar levels, which improves stability but does not delay signal timing |

| Fewer false signals caused by shifting VA levels | Works well with volume filters and threshold settings, especially during volatile sessions |

| More reliable and easier-to-interpret breakout signals | |

| Ideal for traders who prefer analyzing breakouts based on stable reference levels |

Flexible Value Area Period Configuration

The indicator supports flexible Value Area period settings: standard (session, day, week) or custom. In custom mode, traders can define start and end times down to the minute, allowing precise adaptation to specific trading windows and strategies.

Threshold Condition for Signal Filtering

The indicator includes a Threshold setting that defines the minimum distance price must travel beyond VAH or VAL for a breakout signal to be confirmed. This filters out minor level touches, eliminates weak or false breakouts, and focuses attention on meaningful moves.

Volume Profile and VA Dynamics Visualization

The indicator displays the Volume Profile, VAH and VAL levels, and their evolution over time. Historical VA lines show how the Value Area develops as the session unfolds. All visual components can be toggled on or off, giving traders full control.

The indicator displays the Volume Profile, VAH and VAL levels, and their evolution over time. Historical VA lines show how the Value Area develops as the session unfolds. All visual components can be toggled on or off, giving traders full control.

These visual tools help traders understand not only current levels but also how they formed, adding valuable market context.

Additional Signal Filters

The indicator supports additional filters to improve signal quality and reliability:

The indicator has the following parameters:

Alerts – Configure various types of alerts.

Session Period – Defines the period used for Value Area calculation: Custom Session, Session, Day, or Week.

Min Session Progress (%) – Specifies the minimum session progress (in %) required before the indicator starts detecting breakout signals. This helps avoid signals during the early session phase when price ranges are still forming, market direction is unclear, and breakouts are often weak or unreliable.

Breakout Check Mode – breakout detection mode: Live (current bar) or Locked (previous bar fixed levels).

Breakout Price Type – price type for breakout confirmation: Close or High/Low.

Value Area (%) – Sets the percentage of total volume that defines the Value Area. The default is typically 70%, but this can be adjusted to match different volume profile methodologies.

Ticks Per Level – Determines the number of price ticks aggregated into one Volume Profile level. A higher value creates a coarser profile, while a lower value provides finer granularity.

Enable Repeat Signals – Enables repeated breakout signals if another breakout occurs on the following bar. Signals will continue until price closes back inside the Value Area. When disabled, this parameter prevents excessive signal duplication.

Enable Volume MA Check – Activates the average volume filter, allowing breakout signals only if bar volume exceeds a calculated average volume threshold.

Volume MA Period – Defines the lookback period used to calculate average volume for the volume filter.

Average Volume Multiplier – Sets the multiplier applied to the average volume. A signal is valid only if the current bar’s volume exceeds (Average Volume × Multiplier).

Enable Min Volume Check – Enables the minimum volume filter, requiring bar volume to exceed a fixed minimum level for a breakout signal to be valid.

Enable VWAP Check – Activates the VWAP filter, which verifies that price is above or below VWAP depending on breakout direction, helping confirm breakout strength.

Enable Threshold – Enables the Threshold filter, which requires price to move beyond VAH or VAL by a specified amount before confirming a breakout.

Threshold Value Mode – unit of measurement for threshold: percent, ticks, points.

Threshold Value – Specifies the required distance price must travel beyond VAH or VAL according to the selected Threshold Value Mode.

Threshold Max Wait Bars – sets the maximum number of bars allowed for price to reach the defined Threshold Value after a VA breakout. A value of 0 means only the current bar is considered, while 5 allows up to 5 bars after the breakout to meet the threshold.

We can also turn the indicator into an Automated Trading Strategy with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

We are committed to the ongoing development and refinement of our indicators. If you’ve spotted a bug, feel that something essential is missing, or have ideas that could make the indicator even better, just send us a message. Your feedback helps us improve and deliver tools that truly meet traders’ needs.

| Signal Plot Name |

Signal Plot Values | Description |

| BullishBreakoutPoint | Value | |

| BearishBreakoutPoint | Value | |

| VahHistory | Value | |

| ValHistory | Value | |

| VWAP | Value | |

| VolAvg | Value |

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.