The Anchored VWAP Indicator for NinjaTrader is a flexible analytical tool that enhances the traditional VWAP concept by allowing traders to start the volume-weighted average price calculation from any specific point on the chart. Unlike standard VWAP, which resets based on a fixed period (such as a session, day, or week), Anchored VWAP continues to update from the anchor point, offering a more event-focused and continuous view of market structure.

This tool is especially useful for identifying volume-adjusted price dynamics, support and resistance zones, and key turning points after significant market events. Traders can anchor VWAP to earnings releases, news spikes, market highs/lows, or any relevant price level to monitor how price behaves from that moment forward.

In practice, the Anchored VWAP serves as a dynamic reference point, allowing traders to assess in real time how price behaves relative to the volume-weighted average since a key event. When the price is above the Anchored VWAP line, it indicates that buyers have been in control since the anchor point; when the price is below, it suggests that sellers are dominating. This makes the indicator especially useful for both trend-following strategies and mean-reversion setups.

Anchored VWAP can be used in a variety of ways:

Contextual Analysis

By anchoring VWAP to specific events on the chart—such as major economic data releases, news announcements, or significant highs and lows—traders can better understand how the market is reacting to key developments or ongoing trends.

Volume-Weighted Support and Resistance

The anchored VWAP line often acts like a magnet for price, forming strong support or resistance levels based on cumulative volume. These levels tend to attract attention from institutional traders

Trend Assessment

When price consistently holds above the anchored VWAP, it indicates sustained bullish momentum. Conversely, when price remains below, it reflects ongoing bearish pressure. This helps traders confirm existing trends or identify potential reversals.

Market Reaction Analysis

Traders can use Anchored VWAP to evaluate how the market has responded to macroeconomic data, breakout points, or other significant events by analyzing post-event price behavior.

Advantages of Using Anchored VWAP:

Adaptability: Traders have the ability to set the anchor point anywhere on the chart, which makes this tool highly adaptable for analyzing different market conditions and timeframes.

Event-Based Insight: Anchoring VWAP to a specific market event gives traders clearer insight into how price has behaved in response to that event over time.

Strategy Compatibility: Anchored VWAP can be tailored to match a wide range of trading approaches and individual preferences.

Practical Example: A trader might anchor the VWAP at a major swing high to see how price behaves as it revisits that level, helping to identify key areas of interest like reversion zones or emerging support.

The indicator has the following parameters:

Alerts – Configure various types of alerts.

Anchor Time – Specifies the initial anchor point from which the Anchored VWAP calculation begins when the indicator is first loaded onto the chart. This serves as the starting reference for the VWAP line. After loading, the anchor can be freely moved on the chart to any desired point for further analysis.

Show Amount of Bands – specifies how many standard deviation bands will be displayed around the VWAP line.

Bands Calculation Mode – determines the method used to calculate the deviation bands. Traders can either use standard deviation multipliers or specify these multipliers as percentages instead of traditional coefficient values.

Bands Multiplier 1 / 2 / 3 – these fields set the multiplier values for the deviation bands. For example, a value of “1” for Multiplier 1 plots a band one standard deviation away from the VWAP line.

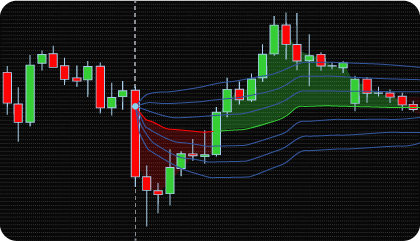

Enable VWAP Slope-based Coloring – activates dynamic color changes for the VWAP line based on its relationship to price action: green when the price is above VWAP, and red when below. This visual cue helps traders quickly assess short-term trend direction.

Enable Bands Zones Color Fill – Enables color filling for enhanced visual context. This feature supports two modes: Standard fill, which consistently colors the area between the VWAP line and its deviation bands, and Bullish/Bearish fill, which dynamically fills the area between the price and VWAP—green when the price is above VWAP and red when it is below—highlighting prevailing market sentiment.

We can also turn the indicator into an Automated Trading Strategy with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

We are committed to the ongoing development and refinement of our indicators. If you’ve spotted a bug, feel that something essential is missing, or have ideas that could make the indicator even better, just send us a message. Your feedback helps us improve and deliver tools that truly meet traders’ needs.

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.