The NinjaTrader Premium & Discount Zones Indicator is built on the ICT and Smart Money methodology, formalizing the principle of price distribution relative to its fair value. Fair value is defined as the midpoint of the range (equilibrium), serving as a key reference point for evaluating current price position and dividing the range into Premium and Discount zones in relation to market balance.

From a practical standpoint, the indicator provides traders with a tool for evaluating price in the context of market equilibrium. It is not simply a visual split of the chart into top and bottom, but a structured methodology for understanding where price is “expensive” or “cheap” based on liquidity distribution and institutional logic.

Knowing which zone the market is in allows traders to assess the current situation more objectively and build positions strategically:

In this way, the NinjaTrader Premium & Discount Zones Indicator helps clearly identify whether an asset is trading at a premium or discount relative to its equilibrium, and use this context to find optimal entry and exit levels.

The NinjaTrader Premium & Discount Zones Indicator provides practical and convenient tools, allowing traders to adjust settings for different trading styles and approaches. These features include:

Building Zones by Sessions, Days, and Weeks

The Premium & Discount Zones Indicator builds zones for Session, Day, and Week periods, calculating the range based on High and Low extremes and automatically updating it as new values form. This approach allows traders to see the current premium and discount levels in the context of daily, weekly, or session movements, providing a clear view of the boundaries of the current market range. It is especially useful for analyzing intraday dynamics and for traders who build strategies around fixed ranges.

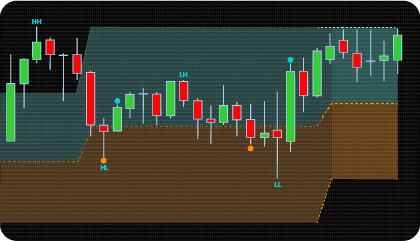

Building Zones Based on the Last Swing Point

In Last Swing mode, the indicator defines Premium and Discount zone ranges based on the most recent confirmed local highs and lows (HH and LL). This approach allows traders to focus on the current market structure, emphasizing the most significant recent price impulses. Swing-based zones are especially useful for strategies involving trend changes, extreme confirmations, or market reversal analysis. The indicator automatically updates zones as new swings form, providing flexible adaptation to the current market phase.

A key feature of this mode is that the range does not update immediately when price touches an extreme, but only after the swing has been confirmed. Zone updates on the chart occur only when the local high or low is validated according to fractal logic. This is controlled by the Swing Strength parameter, which sets the number of bars required to confirm a swing. Higher values increase the strictness of the filter: an extreme is recognized only if it is surrounded by a sufficient number of bars with lower highs (for a peak) or higher lows (for a trough). This approach reduces false zone updates and provides a more structured and accurate representation of market dynamics.

Custom Time Range

The indicator supports a Custom Session mode, allowing traders to define their own time range with minute-level precision. This is especially useful for strategies targeting non-standard trading periods, such as the European market open or localized periods of high activity. The ability to customize the time range makes the tool versatile: it can be adapted for both intraday and positional trading, highlighting periods where liquidity is concentrated or volatility is at its peak.

Additional Analysis Levels

For more detailed zone analysis, the indicator provides optional levels — the classic 38.2% and 61.8%, or, if needed, 25% and 75%. These levels help identify “deep” Premium and Discount zones, where the probability of a price reaction is higher. In ICT methodology, such areas are considered key entry points, as they often serve as liquidity zones and triggers for new impulses. Using additional levels allows traders not only to monitor the base 50% balance but also to analyze more precise boundaries, where the likelihood of a successful trade is significantly higher. These levels can also serve as thresholds for filtering signals, enabling more accurate identification of entry and exit zones while aligning with the trader’s individual analysis style.

Alerts & Signal System

The indicator includes an advanced alerts and signals system for tracking key market events. Signals can be triggered on equilibrium crosses or additional Fibonacci levels. Flexible options also allow disabling chart signals when using the indicator alongside other tools, preserving a clean chart view.

Flexible Visualization Settings

To improve clarity, the indicator offers extended visualization settings. Traders can adjust the colors of Equilibrium, Discount, and Premium zones, enable or disable zone shading, modify line colors and styles, and control transparency. This allows users to tailor the display to their personal workflow while preserving analytical convenience when combining with other indicators. Clear visualization enhances chart readability and supports faster, more confident trading decisions.

The indicator has the following parameters:

Alerts – Configure various types of alerts.

Swing Strength – Defines the number of bars the indicator considers when identifying local highs and lows based on fractal logic. A higher value increases the strictness of the swing definition, as the extreme must be surrounded by more bars with lower highs (for a top) or higher lows (for a bottom).

Session Period – selects the type of range calculation. Options: Last Swing (based on the most recent confirmed local highs and lows) or Session, Day, Week, Custom Session (time-based periods). Determines the extremes and the period used to form Premium and Discount zones.

Min Session Progress (%) – minimum session progress percentage before signals are activated. Prevents signals at the session start when the range is not yet formed and reference points are unclear.

Show History Sessions – enables or disables the display of past zones built according to the selected range calculation type (Session, Day, Week, Custom Session, or Last Swing). If disabled, only the current zone is shown on the chart.

Session/Swing Zones Drawing Limit – limits the number of past zones, built according to the selected range calculation type (Session, Day, Week, Custom Session, or Last Swing), displayed on the chart.

Enable Alerts – enables or disables notifications when key zone levels are crossed.

Display Signals – enables or disables visual signals on the chart for crossings of Equilibrium or Fibonacci levels.

Alert & Signal Source – method for generating signals: Equilibrium cross, Fibonacci level cross, or both simultaneously.

Trigger Action Type – the price type used for triggering signals and alerts (Close or High/Low). Determines which price value is considered for level crossings.

Show Fibonacci Level – enables or disables additional Fibonacci levels.

We can also turn the indicator into an Automated Trading Strategy with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

We are committed to the ongoing development and refinement of our indicators. If you’ve spotted a bug, feel that something essential is missing, or have ideas that could make the indicator even better, just send us a message. Your feedback helps us improve and deliver tools that truly meet traders’ needs.

| Signal Plot Name |

Signal Plot Values | Description |

| EnterDiscountZone | Value | |

| EnterPremiumZone | Value | |

| EquilibriumLine | Value | |

| PremiumLine | Value | |

| DiscountLine | Value | |

| FibUpperLine | Value | |

| FibLowerLine | Value |

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.