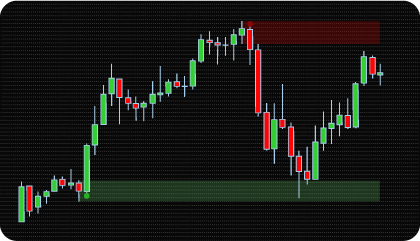

NinjaTrader Order Block Indicator is based on one of the key concepts of the ICT and Smart Money methodologies — the analysis of Order Blocks. These zones are formed in areas where large market participants (banks, funds, institutional players) are active and create a visible imbalance between supply and demand. Later, the price often returns to these areas to test them before continuing its movement.

For traders, understanding the concept of Order Blocks provides access to a deeper view of market structure. Unlike traditional support and resistance levels, Order Blocks do not simply highlight local extremes, but instead point to real areas of institutional interest where liquidity was concentrated. Working with them allows traders to align their trading decisions with institutional logic and better understand the underlying mechanics of the market.

From the perspective of market mechanics, an Order Block is not just a candlestick formation, but a reflection of liquidity. Institutional participants rarely execute their full position at once. Instead, they build it in stages, creating liquidity clusters that remain important reference points for future price action. This is why, after an impulsive move, the price often returns to the area of initial liquidity accumulation, making these zones essential for analysis.

The importance of Order Blocks can be summarized in several key points:

For practical use, the parameters of how these zones are defined and managed are crucial. NinjaTrader Order Block Indicator provides flexible settings: choosing the calculation method (based on highs/lows or open/close prices), defining the conditions for Mitigation (full or partial), and setting limits for zone size and lifetime. A particularly valuable feature is the ability to adjust mitigation thresholds, which makes it possible to control when a block is considered absorbed. These tools help filter out insignificant formations and focus on truly meaningful market imbalances.

The NinjaTrader Order Block Indicator combines advanced tools and features specifically designed to help traders identify, analyze, and manage Order Blocks with accuracy. Its functions allow traders to control and calibrate Order Block settings, finely adjusting parameters to adapt the indicator to diverse trading strategies, individual approaches, and varying market conditions. These features include:

Order Block Range & Size Definition

These settings allow traders to define what constitutes a valid Order Block, selecting range type (High–Low, Open–Close, or Open–High/Low depending on bullish or bearish block), minimum price movement (Gap Size Mode), and minimum number of bars (OB Min Length). This ensures only significant zones reflecting institutional activity are highlighted.

Complete & Partial Mitigation Control

Traders can choose between full or partial mitigation, as well as define the price type (Close or High/Low) that validates the event. This flexibility allows precise alignment with different trading strategies and risk management approaches.

Threshold-Based Mitigation Tuning

Traders can set percentage thresholds to define when a block is considered mitigated, choose to trigger alerts only, or simply display a reference line. This feature allows precise adjustment of sensitivity and supports accurate recognition of impactful institutional zones.

Event-Specific Alert System

Alerts notify traders of key Order Block events — formation, price entry, and mitigation. This ensures that important developments in market structure are observed in real time, supporting timely trading decisions.

Enhanced Order Block Visualization

Traders can customize colors for bullish, bearish, active, mitigated, and expired Order Blocks. Flexible filters allow displaying all, only active, or specific inactive blocks, improving chart clarity and focusing attention on relevant zones.

The indicator has the following parameters:

Alerts – Configure various types of alerts.

Show OB Type – defines which types of Order Blocks will be displayed on the chart: only active, all inactive (mitigated/expired), or both. This allows traders to focus on current signals or review historical data.

OB Range Type – defines the method for drawing the boundaries of an Order Block. The range can be determined using High/Low, Open/Close, or a combined option Open + High/Low.

Mitigation Method – defines when an Order Block is considered mitigated: either after the price fully passes through it or upon a partial touch. This setting allows adaptation to different trading approaches.

Mitigation Price Type – specifies which candle price confirms the block’s mitigation: Close or High/Low.

Gap Size Mode / Minimum Gap Size – filters the minimum size of an Order Block in ticks or percentages, helping to eliminate insignificant zones.

OB Min Length (bars) – sets the minimum number of bars required to form a block, excluding overly short zones that have little practical relevance.

Max OB Duration – the maximum time an Order Block can remain active before it is considered expired. If Mitigation does not occur within the set period (e.g., 50 bars), the block automatically changes to expired.

OB Duration Type – defines the unit of measurement for Max OB Duration, either bars or minutes.

Enable OB Display Limit – limits the number of Order Blocks displayed on the chart.

Enable Threshold – activates a threshold line within the block to monitor the depth of price entry. If the additional settings (Mitigation at Threshold and Enable Threshold Alert) are disabled, the line can serve as a visual reference (for example, as a simple midpoint of the OB). Traders can use it as a guide for decision-making.

Threshold Value (%) – sets the threshold line level as a percentage of the block’s size.

Mitigation at Threshold – when enabled, the block is considered mitigated when the price touches the specified Threshold level. In this mode, the Mitigation Method setting is ignored. This feature allows traders to configure more flexible rules for block mitigation.

Enable Threshold Alert – activates an alert when the price touches the threshold line.

OB Creation Alert – activates an alert when a new Order Block is formed.

OB Entry Alert – activates an alert when the price enters the block zone.

OB Mitigated Alert – activates an alert when a block is mitigated.

OB Visual Settings – visual display settings, including colors for active and inactive (mitigated and expired) blocks, as well as transparency. These settings allow traders to customize the indicator’s appearance to their preferences and make the chart as clear and convenient for analysis as possible.

We can also turn the indicator into an Automated Trading Strategy with an extended set of custom functions (stop loss, take profit, trailing stop, risk management parameters, trading time limit, and others).

Request a free consultation from our team of professional programmers and find out the cost and timing of your project development.

We are committed to the ongoing development and refinement of our indicators. If you’ve spotted a bug, feel that something essential is missing, or have ideas that could make the indicator even better, just send us a message. Your feedback helps us improve and deliver tools that truly meet traders’ needs.

| Signal Plot Name |

Signal Plot Values | Description |

| OrderBlockCreated | Value | |

| FillPoint | Value | |

| MitigatedPoint | Value |

Nordman Algorithms is not liable for any risk that you face using the software. Please, use the software on your own responsibility. The software is coded in accordance with a common known concept and Nordman Algorithms does not guarantee accuracy or trading performance of the software signals.

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure.

CFTC Rules 4.41 – Hypothetical or Simulated performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.