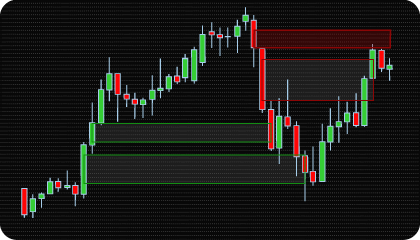

The NinjaTrader Fair Value Gap (FVG) Indicator is based on the concept of price imbalance — a key element of ICT and Smart Money methodologies. A Fair Value Gap forms during an impulsive price movement when the market moves through a range so quickly that buy and sell orders do not interact evenly. As a result, an inefficiency is created, leaving behind an area where price was not fairly traded.

From a market mechanics perspective, FVGs represent moments when dominant market participants control the order flow. Large institutions often initiate positions using aggressive market orders, driving price rapidly in one direction. Because liquidity is not fully absorbed at every price level, gaps in fair value emerge. These imbalances reflect institutional order flow dynamics and serve as significant reference points within a structural market context.

One of the defining characteristics of Fair Value Gaps is their role as significant reference areas where price may seek rebalancing. After an impulsive move, the market often interacts with the imbalance zone to mitigate unfilled orders as part of its structural development. This behavior makes FVGs important reference areas for contextual analysis rather than standalone execution triggers. They highlight zones of potential price interaction and structural interest.

The NinjaTrader Fair Value Gap Indicator automates the identification of these imbalance zones, removing subjective interpretation and ensuring consistent detection across different market conditions. By clearly marking FVG areas on the chart, the indicator helps traders visualize where inefficiencies were created and how price interacts with them over time.

In practical trading analysis, Fair Value Gaps serve several important purposes:

Instead of treating price movement as a series of isolated candles, the FVG methodology frames the market as a process of imbalance and compensation. The NinjaTrader Fair Value Gap Indicator supports this perspective by integrating imbalance analysis directly into the chart, allowing traders to integrate imbalance analysis into their methodology based on the underlying logic of order flow.

The NinjaTrader FVG Indicator combines advanced tools and features designed to help traders systematically identify, analyze, and manage Fair Value Gaps. Its functionality allows traders to control and fine-tune FVG detection, validation, and mitigation logic, enabling flexible configuration for different trading strategies and market conditions. These features include:

This feature defines when a Fair Value Gap is considered mitigated. Traders can choose full fill, partial touch, or threshold-based mitigation, as well as the price reference used for validation (High/Low or Close). This flexibility allows traders to adapt FVG mitigation logic to different trading styles, execution models, and strategy rules, rather than being locked into a single rigid interpretation common in default indicators.

This component controls which FVGs are considered relevant. Traders can filter by bullish, bearish, or both directions, define minimum gap size in ticks, points, or percentages, set a minimum bar span, and limit FVG lifetime in bars. It filters minor or outdated imbalances, optimizing chart clarity, and focuses analysis on structurally meaningful zones.

The indicator provides alerts for FVG formation, price entry into a zone, and mitigation events, enabling traders to track key imbalance interactions in real time. Exposed analytical plots allow FVG events to be integrated directly into automated logic and broader analytical frameworks.

Traders can choose between standard or shrink display modes and fully customize colors and opacities for bullish, bearish, mitigated, and expired zones, ensuring clear distinction even on busy charts. This provides a clear visual context for FVG behavior and price interaction over time.

The indicator has the following parameters:

Allowed Direction – defines which Fair Value Gaps are processed by the indicator. The BOTH option enables detection of bullish and bearish FVGs, while Long or Short restrict analysis to one directional bias only.

Show FVG Type – controls which FVG states are displayed on the chart. Traders can choose to show all detected FVGs, only active zones, or specific inactive states such as mitigated or expired zones.

FVG Display Type – controls how FVG zones are visually rendered on the chart. Default mode displays fixed zones, while Shrink mode dynamically reduces the zone size as price partially fills the imbalance.

Mitigation Method – defines when a Fair Value Gap is considered mitigated. Available options include full fill, partial touch, or threshold-based mitigation, allowing adaptation to different execution and analysis styles.

Mitigated Price Type – specifies which candle price is used to validate mitigation events. Traders can choose between High/Low or Close, depending on whether mitigation should be confirmed by extremes or by closing price.

Gap Size Mode – defines the unit used to measure the size of an FVG gap. Available options include ticks, points, or percentages, providing flexibility across instruments and price scales.

Minimum Gap Size – sets the minimum allowed FVG size based on the selected Gap Size Mode. This parameter filters out small imbalances that lack structural or trading relevance.

FVG Min Length (bars) – defines the minimum number of bars required for an FVG to be detected. This helps exclude short-lived or insignificant gaps from analysis.

Max FVG Duration – sets the maximum number of bars an FVG can remain active. If no mitigation occurs within this period, the zone is automatically marked as expired.

Enable FVGs Display Limit – limits the number of most recent FVGs displayed on the chart, helping maintain visual clarity during extended analysis periods.

FVG Alerts – enables alerts for key FVG events, including zone creation, price entry into an FVG, and mitigation.

We can customize this indicator to your needs — adding functions, modifying logic, or integrating it with other tools for your workflow.

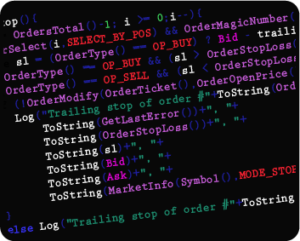

We also convert indicators into Automated Trading Strategies with advanced functions (trailing stops, risk management, filters) tailored to your trading style strictly according to your specifications.

Request a free consultation to discuss the technical scope and timeline of your project.

We are committed to the ongoing development and refinement of our indicators. If you’ve spotted a bug, feel that something essential is missing, or have ideas that could make the indicator even better, just send us a message. Your feedback helps us improve and deliver tools that truly meet traders’ needs.

The indicator provides a set of exposed analytical plot outputs designed for structured integration with third-party strategy builders and automation tools such as BloodHound and BlackBird (SharkIndicators), as well as other algorithmic trading environments.

| Analytical Plot Name | Output Values | Description |

| FVG | Value | |

| MitigatedPoint | Value |

Plot output names and descriptions are technical identifiers intended solely for software integration purposes and do not constitute trading advice, signals, or recommendations.

Nordman Algorithms is a trade name of Nordman Algorithms OÜ (Reg. No. 14435535), registered in Tallinn, Estonia.

Software Nature & User Responsibility — Nordman Algorithms provides algorithmic software tools for technical analysis. Nordman Algorithms is not a financial advisor and is not liable for any losses. All trades conducted based on the software’s output are executed at the user’s sole discretion and risk.

Visual Markers & Signal Disclosure — This software may display visual markers (such as arrows, dots, or alerts) when predefined mathematical conditions are met. These markers are provided for educational and analytical purposes only, must not be interpreted as financial guidance, and do not constitute a recommendation to buy, sell, or hold any financial instrument. Users must independently validate all visual cues within their own trading methodology.

No Financial Advice — Nordman Algorithms does not provide discretionary trading signals, investment advice, or managed signal services. Our software represents a mathematical visualization of historical and real-time data. The appearance of a visual marker does not guarantee a profitable trade or predict future market behavior.

Trading Risk Warning — Futures, Forex, and options trading involve significant risk. Risk capital is money that can be lost without jeopardizing financial security. Only risk capital should be used for trading. Past performance is not indicative of future results. View Full Risk Disclosure: https://www.nordman-algorithms.com/risk-disclosure/

ESMA Risk Warning — Financial instruments, especially those involving leverage such as CFDs and Forex, are complex and carry a high risk of rapid financial loss. Our software provides analytical outputs and visual markers based on predefined mathematical conditions and does not mitigate or reduce inherent market risks. You should carefully consider whether you understand how leveraged financial instruments work and whether you can afford the high risk of losing your capital.

CFTC Rule 4.41 — Hypothetical or simulated performance results have inherent limitations. Unlike actual performance records, simulated results do not represent real trading. Because trades have not actually been executed, these results may under- or over-compensate for the impact of market factors such as liquidity. No representation is being made that any account will achieve profits or losses similar to those shown.

Trademark Notice — NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.